Very important information to read:

This article is intended as a preliminary guide only and refers to some but not all elements required to consider in detail prior to starting any property dealings or due diligence. Property dealings are often complex, especially in foreign countries and we highly recommend you seek independent professional advice... read more... There are a number of taxes involved with the purchase of property for foreign buyers in Japan, according to the Jones Lang LaSalle Japan Property Investment Guide 2015.

Taxes on acquisition and transfer of real estate

Consumption tax

Consumption tax (shouhizei) applies to the sale of a building in Japan, but not to the sale of land as in Japan, ownership of buildings and land are separate rights. So in case of both land and building(s) being transferred in the same transaction, consumption tax is levied on the purchase price of the buildings only. Especially for older, fully depreciated buildings, it can be very low or almost zero.

Consumption tax applies regardless of whether the seller actually resides in Japan or is deemed to be permanently established under Japanese income tax rules. However, there is an exception for both foreign and Japanese sellers that do not qualify as a ‘taxable enterprise’ for Japanese consumption tax purposes (shouhizei kazeijigyou), which are defined as any person/entity with more than JPY 10 million revenue in the fiscal year two years prior to the date of transfer. They are exempted from having to pay consumption tax.

While the seller is legally responsible for paying consumption tax to the national tax authorities (currently 8%, with rises planned in the future), it is usually the buyer who pays the consumption tax in addition to the agreed purchase price.

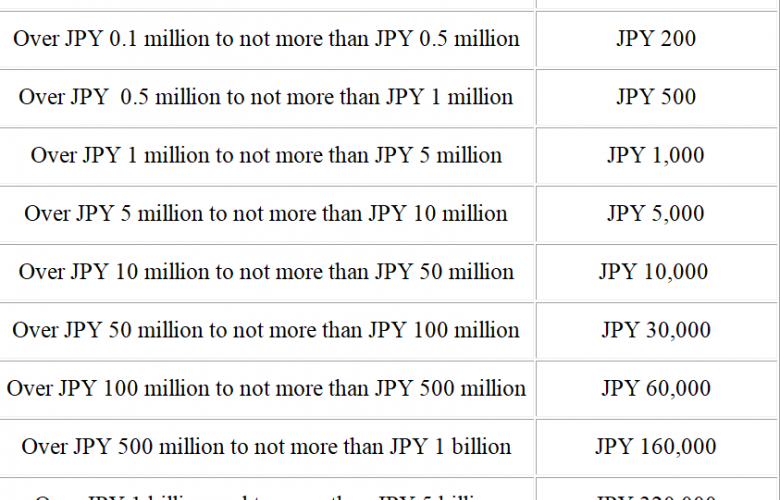

Stamp tax (also known as stamp duty)

Stamp tax is levied on certain documents such as contracts, bills, and share certificates by affixing revenue stamps (as pictured) in the amount equal to the applicable stamp tax. Tax rates vary from JPY 200 (for real estate transactions below JPY 0.5 million) to JPY 480,000 (for those over JPY 5 billion).

Stamp duty for real estate contracts

Source: National Tax Agency

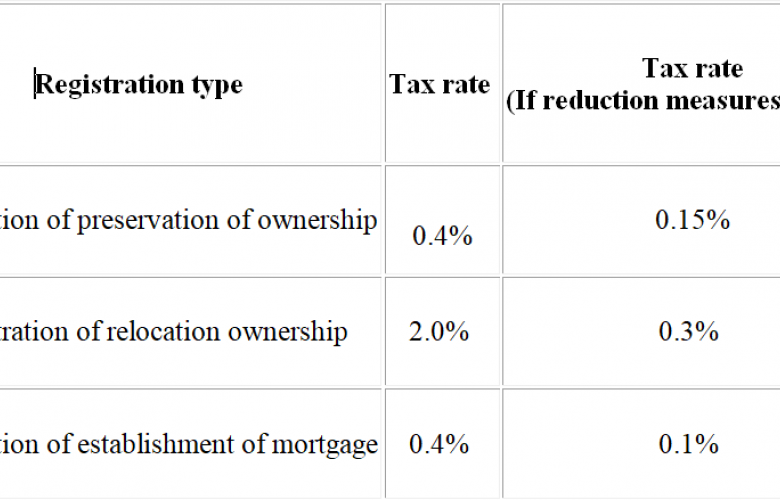

Registration and licence tax

This tax is levied on the registration with respect to real estate, companies, and so on. The tax rate — between 0.4% to 2% — depends on factors such as the type of the transaction and the value of the real estate.

*(Up to March 31, 2020) | Source: National Tax Agency

Real estate acquisition tax

This tax is imposed only once on the acquisition of land or buildings at the rate of 3% (for land and residential buildings) or 4% (for non-residential buildings) in the case of buying and selling, donations, exchanges, and construction.

It is not levied in the case of inheritance. However, inheritance tax or gift tax might apply in case a property has been acquired through those means.

Capital gains tax

For individuals, capital gains from the transfer of land and buildings are subject to capital gains tax (consisting of a national [income] tax component and a local [residential] tax component). The capital gains tax rates are shown below, and the tax is calculated separately from income tax on other income.

Holding period of land

Five years or less: Income tax is 30% and residential tax is 9%

Over five years: Income tax is 15% and residential tax is 5%

It should be noted that depreciation of the building, but never the land, can be deducted from this.

While all of the taxes above are usually paid by the buying side in a real estate transaction and added to the sales price, it is the norm in Japan that the selling side pays the capital gains tax.

Value added tax / Goods and services tax

Under this tax, the sale or lease of land and lease of residential buildings are deemed non-taxable.

Taxes on possession and operation of real estate

Fixed asset tax

This is levied on land, buildings, and tangible business assets. Both residents and non-residents who are registered as the owners of a fixed asset in the tax register book as of January 1 of each year are obliged to pay the fixed asset tax.

The amount of this tax is based on the applicable tax rate (usually 1.4%) and the assessed value of the fixed asset. Furthermore, it should be noted that the calculated value is usually substantially below the market value.

City planning tax

This is a surtax on the fixed asset tax, and is usually levied at a rate of 0.3% on land and buildings within city planning zones.

Tax depreciation

Depreciation for a building can be deducted as a necessary expense from the amount of income from real estate for Japanese tax purposes. However, the cost of land cannot be depreciated.

Personal taxation

Personal tax rates also apply to foreigners, depending on whether they are classed as residents or non-residents and can apply to e.g. rental income from properties. Tax rates are subject to the total of taxable income and vary from 5% to 40%.

However, It is also worth noting that there is a treaty for the avoidance of double taxation between Japan and Australia, Hong Kong, the UK, most EU nations, and many other countries.

Source: Jones Lang LaSalle Japan Property Investment Guide 2015.

This post was updated in October 2018 by Mareike Dornhege.

Further reading:

Very important information to read:

This article and the above linked articles are not complete and are intended as preliminary guides only. These guides refer to some elements to consider prior to starting any property dealings or due diligence. Property dealings are often complex areas, especially in foreign countries and we highly recommend you seek independent professional advice... read more...