Why Japan? Why Now?

As stock markets display volatility, investors turn to safe havens where assets generally outperform during periods of uncertainty.

The Japanese yen is one such market, a place to ride out the storm – and Japan’s property market, while experiencing some growth in recent years, mainly in larger metropolitan centres, is by and large not considered to be a speculative, capital growth-oriented arena.

It’s main attractive factors for investors – at least since the mid-1990s – have been (increasingly so) affordability, high and stable rental yield percentages, and well-documented, hassle-free management and business environment, which offers full legal recourse and clearly documented specifics at all stages of the investment life cycle.

The above-mentioned factors remain doubly true in uncertain times, of course – and shine out in particular, when compared with other, more speculative and growth-oriented investment destinations, which are normally characterized by low, compressed rental yields and relatively high purchase prices.

Such destinations run a far higher risk of market crashes and property bubble bursts when unexpected global events such as the current epidemic occur – which, coupled with low rental yields and a necessity for high financial leveraging, mainly due to sky-high purchase prices – can spell disaster for those who have not sought to mitigate these risks well in advance.

Similarly, for those among us who are more active in stock investments and equity markets, these times can be extremely stressful – since we are often sitting, helpless, on the sidelines, watching our hard-earned savings dwindle away in value, as entire industries are run into the ground in the face of a swiftly changing reality, which catches those industries unprepared, and us, the investors, unable to “steer the ship” toward safety.

And yet, liquidating holdings mid-crisis can be a very bad idea – particularly if the ages-old axiom of “what goes down must come up” turns out to be true – after we’ve already jumped off-board and realized our virtual losses, turning them into painful realities.

Japanese real-estate investment, as opposed to the above scenario, is focused primarily on immediate monthly rental income from properties already occupied, and monies are held in Japan for the benefit of currency exchange, for when other currencies start going back up in value again.

Because this is a high yield market generating 6% to 11% annual yield net pre-tax on these investments, it remains particularly attractive, even more so during volatile times.

Furthermore, as opposed to more traditional, Western property markets, which are reliant on constant capital growth and rental increases for gains – which simply cannot occur during such volatile times.

Japan’s property market, on the other hand, which has already bottomed out, features higher rental yields from the get-go, and is not dependent on speculative growth strategies and/or economic trends, or at least to a far lesser degree.

Currency Fluctuations

Similar things are happening, as they always have happened, with the Japanese yen as well – a currency generally considered to be a safe haven from global turmoil, due to Japan’s highly domestic concentration of sovereign debt – which is not subject to international currency fluctuations as other currencies, issued by countries with a larger concentration of foreign debt denominations – as well as due to Japan’s characteristic and reputation as a highly orderly and law-abiding society. Riots, bank runs and other disruptive “herd mentality” practices are extremely rare – practically non-existent, in fact.

As a result, the Japanese yen is currently gaining in value – and while it hasn’t yet peaked over longer than a few months period against the Singapore Dollar, it may soon reach this point – and has already briefly touched a 4 year peak against the US Dollar and Euro.

The highest peak is currently against the Australian Dollar, against which the Yen is now trading at a level not seen over a decade (trading at 64.75 JPY per AUD as of the writing of this article).

AUD vs JPY chart. Source: Japan Properties

The Opportunity Inherent in Crisis

While we fervently hope, as does the rest of the world, for a swift and effective resolution to the current pandemic – we also realize that times of crisis often spell increased opportunity for those well-positioned and well-prepared in advance, which is the position we advocate to all of our clients on a regular basis.

This means (at all times, and most certainly currently) having the infrastructure in place to enable us to take swift and decisive actions upon the realization of a particularly aggressive market swing or trend – and in the context of the current environment, we believe such a swing to be entering its initial phases now, in all of Japan’s major metropolitan centres.

These cities have gained in value over the past 8 years –most significantly Tokyo, Yokohama, Kawasaki and surrounding areas, as well as Chiba – or, more specifically, the area between Tokyo and Narita international airport in Chiba prefecture – and, to a lesser degree, in Osaka as well.

Huge Increase in Tourism

One of the main reasons for the surprising recovery in Japanese metropolitan property prices in recent years – aside from the “feel-good” rhetoric of prime minister Shinzo Abe’s economic policies, nicknamed “Abenomics,” which have yielded mixed results – has been the huge increase in tourist numbers that Japan has been enjoying since 2011, when it began recovering from the global financial crisis of 2008, as well as from the 25 years of deflation preceding it.

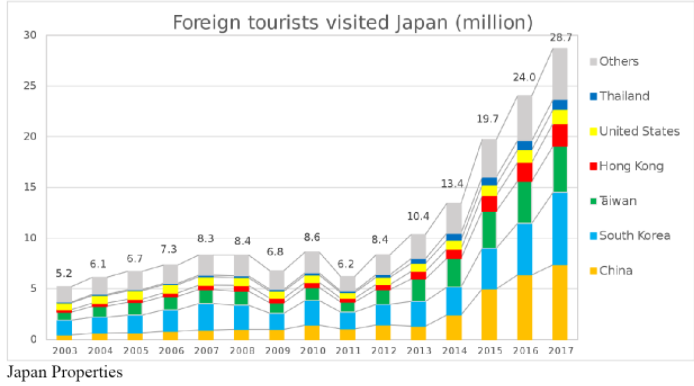

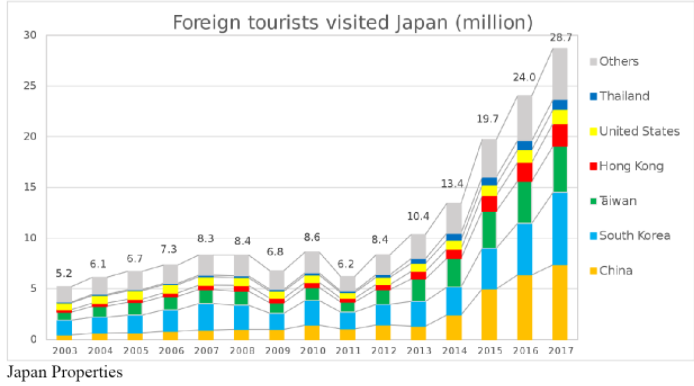

Over this same period of time, tourism numbers have rocketed upwards, gaining exponentially and steadily every year, from 6.2 million visitors in 2011, to over 31 million in 2018.

This sharp increase has placed a huge strain on hotels, guest houses and other hospitality properties, and gave birth to a highly popular trend of small and part-time “minpaku” operators (AirBnb type short term stay properties), who have capitalized on the need for budget accommodation options all around the country – to the point where the government (perhaps in collusion with the powerful hotel and inns lobby) has taken action and passed clearer and more restrictive legislation in June 2019, enforcing compliance requirements and severely limiting operations of non-hotel, non-licensed establishments.

Regardless, however, there are and have been plenty of new inn and hotel license applicants, as well as private individuals operating in a formerly gray, and now slightly illegal zone, who have been benefiting from the huge demand instigated.

And then…

Enter COVID19

Since 31 Dec, 2019, when the new Corona virus symptoms were first noticed in Wuhan, China – and subsequently identified as a new strand of viral infection on 7 Jan, 2020 – the disease spread like wild-fire, first across Asia, then across the rest of the world.

For a while, it seemed as if Japan was going to be the pandemic’s poster child – a trend made worse for a few weeks by an infected cruise ship docked off Yokohama, near Tokyo, with hundreds of infected, quarantined passengers being denied disembarking.

However, due to the Japanese tendency to avoid close physical contact and general cleanliness (according to the optimists), or simply due to lack of testing and accurate reporting (if you ask the pessimists), the curve of confirmed infection cases, as well as deaths related to said infections, flattened significantly – and, coupled with the stellar rise in other countries, such as South-Korea at first, and now Italy, Spain and Iran, Japan has slipped to a far lower rank in the outbreak severity list.

Regardless, with global travel restrictions becoming stricter by the day, businesses and households in lockdown and isolation mode in many cities around the world, and the all but complete global avoidance of public places with high volumes of human traffic, such as airports, busy city centres and tourist attractions – international travel has naturally ground down to almost a complete halt globally – and Japan has not escaped this trend.

Hospitality Crisis

Hotels, inns, guest-houses and AirBnb operators are now in a state of global panic, with close to 90% cancellations as far as the eye can see, and no end to the crisis in sight.

And while even mega-corporations with world-wide coverage and a swathe of accommodation properties in their portfolios are feeling the pain – smaller operators are in a much worse state, with many of them in very real danger of immediate bankruptcy, or already bankrupt – as well as the immediate risk of property foreclosure, for those among them with mortgages on their hospitality properties still in place.

In Japan, specifically, where easements on mortgages and other loan payments have yet to be declared, as of the writing of this article – these landlords and business owners are in an even worse condition.

Farewell, Tokyo 2020

Add to the above the current postponement of the Tokyo 2020 Olympic games to (hopefully) the following year – a move which has kicked off an even larger wave of travel plan cancellations, as well as put a huge dent in the plans of anyone “sitting on” a sale of their Tokyo, Osaka and surrounding areas properties – property owners who were hoping for property prices in these areas to peak closer to the event – and you’ll begin to see a purchasing strategy form itself – particularly for those long-sighted investors among us, who are looking ahead to the post-COVID19 era, re-instatement of the Olympics and other global events (such as the planned World Expo in Osaka, in 2025) – and the return of the tourist droves.

Best Buyers’ Market Since 2008

As a quick browse through any AirBnb operators group or forum online will demonstrate in a heartbeat, there are plenty of distressed guest accommodation operators out there – which is heart-breaking to say the least – but also offers a unique opportunity to both distressed seller – who can avoid foreclosure and perhaps bankruptcy – as well as to the opportunistic buyer – who can now swoop in to save these sellers, and take these distressed properties off their hands for a significantly reduced price in the process.

Similarly, even for owners of non-hospitality related properties in most of Japan’s major cities, who have so far adopted a “wait and see” approach, counting on the 2020 Tokyo Olympics and constantly increasing droves of tourists to further buoy property prices for the foreseeable future – a very real fear of another property bubble crash will now be taking hold.

The above conditions have created the perfect storm, as far as property prices are concerned, and a prudent, long-term-view oriented investor should be able to “beat the herd,” and make some intelligent offers on properties in key locations – price discounts that may have been unthinkable only a month or two ago, can now become reality.

And, while not all of these offers will be successful of course (since non-distressed property owners with a long term view may not be in a hurry to sell) – there should be enough of them out there who will be more than happy to offload their properties, before what they believe may be an imminent market crash comes into effect.

Parallels to the GFC

If we look at the three years between 2008-2011, the peak years of the global financial crisis kicked off by the Lehman Brothers crash and subsequent global mayhem – and according to the International Monetary Fund, the current epidemic generated global recession is poised to be even worse – we can see some frenzied selling taking place, with less well-positioned property owners rushing to offload their seemingly overnight worthless properties at a premium discount – as well as distressed sales and bank foreclosures being announced left, right and centre.

Prices were constantly dropping – however, prime pickings have been singled out and purchased at the very early stages of this cycle – with the majority of its lifespan being characterized by less attractive properties still on the market, and finally real “bottom-feeding” towards the end of it.

It would be therefore wiser – as many of our clients have realized and are now acting on – to step in ahead of the herd and begin to highlight and negotiate prices on the most attractive properties available out there BEFORE everyone and their dog joins the party – and secure a spot in what may just be one of the only safe investment havens in these troubled times.

All of which is to say – NOW IS THE TIME TO ACT –particularly on Tokyo, Yokohama and surrounding areas.

Co-authored by APAC Manager, Ziv Nakajima-Magen and Sales and Marketing Manager, Priti Donnelly