Rents continue to grow steadily across the 23W in general, with all sub-markets except Inner and Outer East posting gains this quarter.

Briefing - Residential Leasing Q3 2018 at a glance

- Average mid-market asking rents in Tokyo’s 23 wards (23W) stand at JPY3,784 per sqm, up 0.4% QoQ and 2.2% YoY.

- Average asking rents in the central five wards (C5W) stand at JPY4,527 per sqm, up 1.6% QoQ and 4.5% YoY.

- Both Inner and Outer East submarkets were down this quarter, while all other submarkets were up.

- The C5W’s premium over average 23W rents, at greater than 19% year to date, looks set to reach a new annual high.

- Occupancy rates fluctuated slightly in Q3/2018, but remain robust and are above 95% in all wards.

- The number of upscale listings has been slowly rising, and so far in 2018 rents for larger apartments have increased faster than for smaller residences.

The Savills Residential Leasing Q3 2018 Briefing shows rents in eastern submarkets, following a strong Q3/2017 with a further uptick in Q1/2018, have since stalled, with a particularly weak performance this quarter.

Tetsuya Kaneko, Savils Director, Head of Research & Consultancy, Japan says "It is possible that rental growth is being held back by residents’ income levels, which tend to be lower than in other submarkets of the 23W, while strong supply levels may also be weighing on the market."

"South, Inner North and Outer North rents rose faster than the 23W average this quarter, but still trailed the C5W. On the other hand, rents in the West rose the most this quarter, twice as quickly as the C5W." Says Tetsuya.

Source: Savills Japan

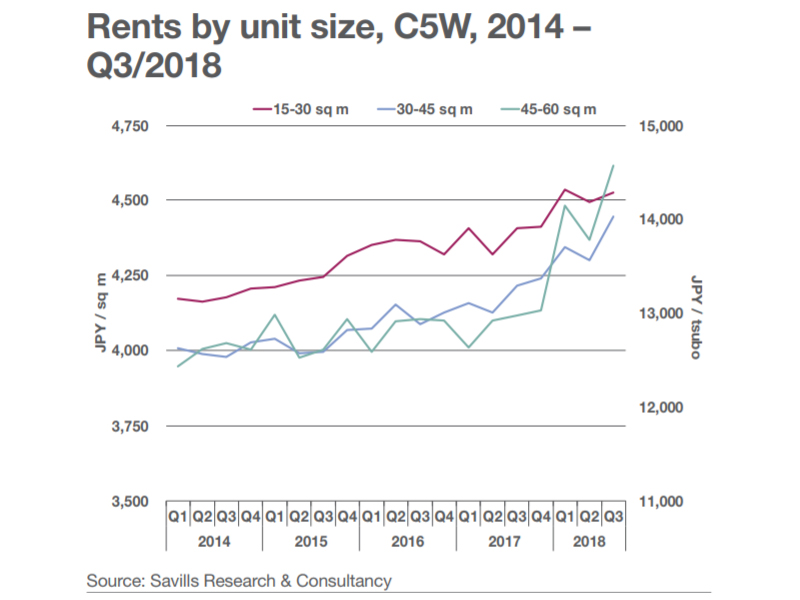

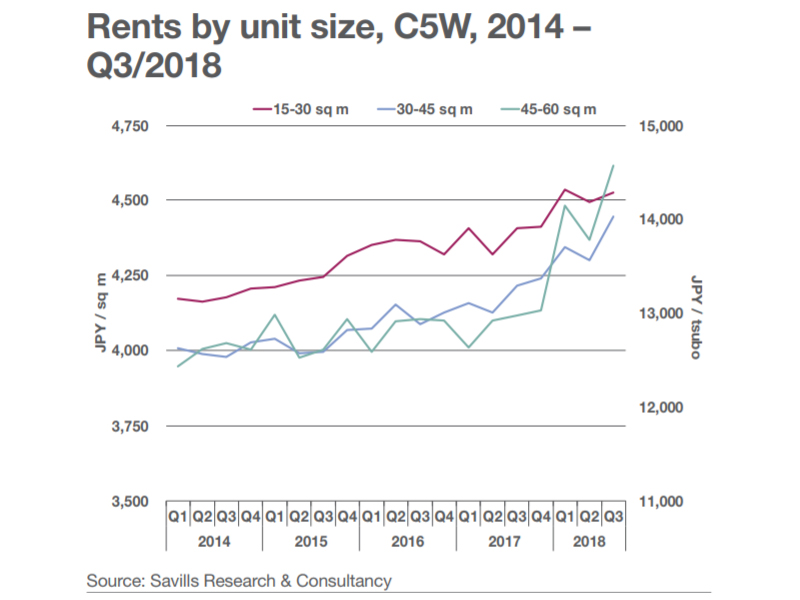

The Savills report shows that so far in 2018 only the C5W has widened its premium versus the 23W. Rents for 45-60 sqm apartments in the C5W spiked for the second time this year and again stand higher than the 15-30 sqm and 30-45 sqm size bands.

"A trend of higher rents per sq m for larger properties may be forming. However, given that large units constitute a much smaller segment of the market, thereby reducing our sample set, new completions are having a pronounced impact on average rents in the size band," says Tetsuya.

"As central Tokyo continues to attract residents, it is likely that strong occupancy is reducing the overall number of listings, particularly for existing apartments, thereby shifting the balance to listings for new or yet-tobe-completed apartments."

"As a result, the average rents derived from these listings may be somewhat higher than actual rents."

Rents by unit size

Savills' report explains that Tokyo’s rental market is principally made up of compact single-occupier units, typically less than 45 sqm (13.6 tsubo) in size.

"Such units can often make up as much as 75% or more of the 23W area’s rental listings."

- Rents for the 15-30 sqm size band ended the quarter at JPY4,525 per sqm.

- Average rents for the 30-45 sqm size band reached JPY4,446 per sqm.

- Average rents for the 45-60 sqm size band rose to JPY4,614 per sqm.

Occupancy rates

- 23W dipped by 0.3 percentage points (ppts) in Q3/2018, but still boasts a healthy average rate of 96.7%

- C5W occupancy recovered by 0.1ppts QoQ to register at 96.1%

- Occupancy is above 95% in all wards.

Outlook

According to Savill's latest briefing report "The labour market is tight and Tokyo households, with rising incomes, appear to be readily absorbing new supply at steadily higher rents. Continued migration to city centres should help rents rise further over the medium term, and household preferences for conveniently located residences should help particularly in the C5W. Occupancy in institutional quality residences is unlikely to weaken for the same reasons."

Savills sites global economic uncertainty as an influence on the wider Japanese economy, but says the effect on the residential leasing market "should be relatively muted. Fundamentals are solid: demand growth from net migration to the 23W appears to be outpacing supply, and residents’ incomes are growing. More pressing concerns include the plan to raise the consumption tax in October 2019, though the government is proposing countermeasures to offset the expected reduction in demand."

Click here to view Savills Briefing - Residential Leasing Q3 2018 report.

For more information or to discuss the report, email or phone Tetsuya Kaneko of Savills Japan via the contact details listed below.

Similar to this:

Average prices of second-hand apartments on the rise in major metropolitan areas

Affordable residential properties: what’s hot, what’s not?

Real estate growth in central Tokyo: Trends to watch