The National Tax Agency Japan’s recent release of its annual average roadside land prices for 2019 showed the national average for the average roadside land price rose by 1.3 percent, over the previous year -- making it the fourth consecutive year it has risen.

At a glance:

- 19 prefectures experience rise in land prices

- Okinawa experienced the largest land price

- Increases attributed to lodging and residential demands

- Tokyo Olympic Games 2020 will keep Tokyo in demand

The average roadside land price is the standard price of land per square meter facing major streets. The price is used as a standard for calculating inheritance taxes and gift taxes in Japan. The number of locations assessed for the Average roadside land price is greater than those for the standard land price that is announced by the Ministry of Land, Infrastructure, Transport and Tourism.

The prefectural average for this year shows that out of 47 prefectures, 19 (including Tokyo, Osaka, and Aichi) have experienced a rise in price far above that of the previous year (18 prefectures in 2018).

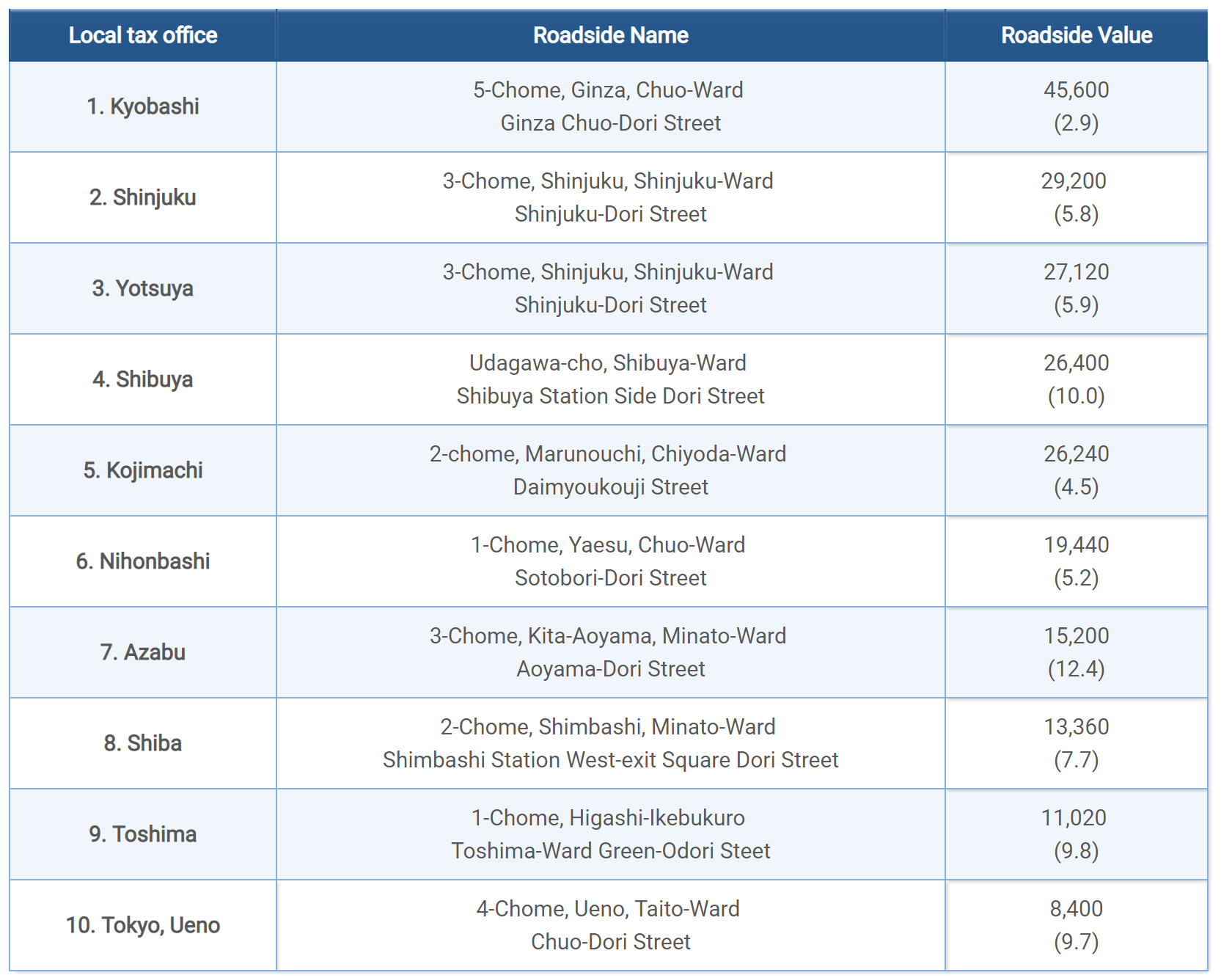

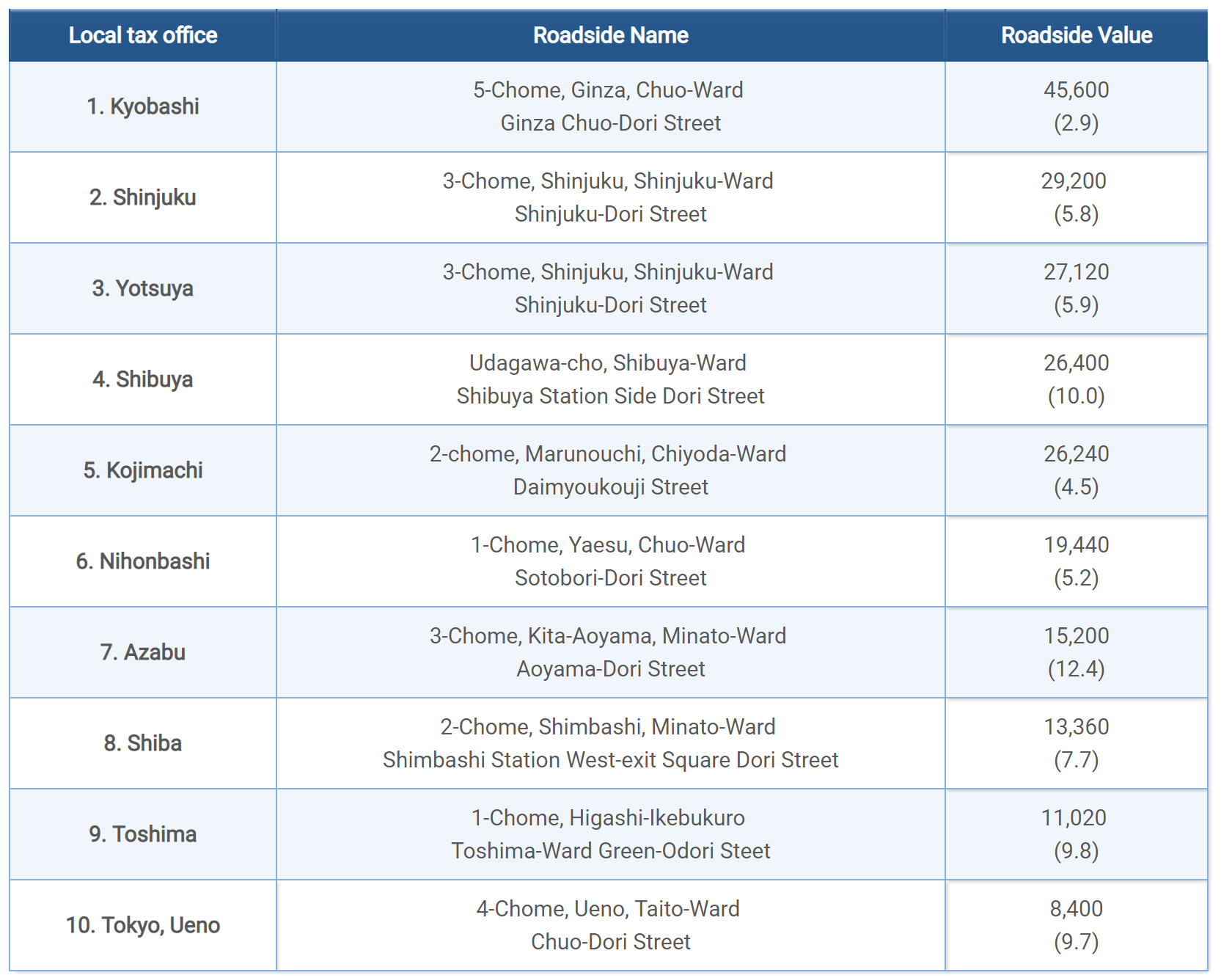

When comparing the nationwide fluctuation of the prefectural land price average, Okinawa’s increase of 8.3 percent (5.0 percent in 2018) was the largest increase over the previous year, followed by Tokyo with an increase of 4.9 percent (4.0 percent in 2018) and Miyagi with an increase of 4.4 percent (3.7 percent in 2018). Okinawa’s average land price increase was partly due to its growing demand for hotels and resort developments. In Tokyo, the highest roadside land price has risen in 46 out of the total 48 neighbourhoods that are covered by a local tax office.

According to the National Tax agency the rise has been mostly attributed to the increase in lodging and residential demands -- which are pushing up the land price in metropolitan districts.

PLAZA HOMES states “some areas are experiencing an increase in land prices due to domestic and overseas investment money for hotel development in some local areas that attract many foreign travellers”. This was coupled with elderly people going back to city areas for the convenience of living is increasing residential demands in city areas nationwide causing land prices to rise.

However some areas other areas were experiencing the opposite effect (downward trend) in their average land prices. Recent shrinking of investment money has contributed to the slowing down in land price rises. According to Urban Research Institute Corporation, a private research institute specialising in real estate, the amount of real estate transactions in 2018 was approximately 3,600 billion yen, which means the land prices are declining toward a level of less than 4,000 billion yen for the first time in six years (since 2012).

Source: 2019/07/02 NIKKEI Newspaper and Tokyo Shimbun

Another market observation shows that investment willingness does not decline although the investors are more conscious about overheating the real estate price and there is a shortage of target properties for investment. While the increase rate of the land price in front of “Kyukyodo” on Ginza Chuo-Dori Street in Chuo ward is declining from a 9.9 percent increase in 2018 (from 2017) to a 2.9 percent increase in 2019 (from 2018), the land price at the exact location has been continuously ranked as having the highest land price in Japan for the past three years.

PLAZA HOMES noted “it is said among real estate marketers that Ginza is a special area which has extraordinary power to attract new investors”.

Tokyo won’t be experiencing slow down any time soon, especially given the Tokyo Olympic Games coming up in 2020. Major real estate service companies believe real estate market demands in the area will continue steadily for a certain period after the Tokyo Olympic Games in 2020.

This will be mostly due to the recent improvements made in Tokyo’s infrastructure and popularity as a place for investment, which has been going up in preparation for and due to the advertisement of the 2020 Olympic Games.

This prediction is partly due to data showing that leased real estate property rent does not decline after the Olympic games in the developed countries where the Olympic games were held in the past.

Click here to visit The National Tax Agency Japan

Source: PLAZA HOMES, The National Tax Agency Japan

Similar to this:

Tokyo apartment sales in June 2019

Tokyo second-hand apartment sales up 8.5% in June 2019

Property Investment For Foreigners: Japan's Earthquakes & Other Natural Disasters