Tokyo real estate has rebounded massively in the last few years, and it seems interest in acquiring property is as strong as ever. This is being fuelled by several trends: the upcoming Tokyo Olympics' promise of revitalisation, migration from abroad and other Japanese regions into the Japanese capital, Abenomics, and historically low interest rates.

In the real estate business, the three most important factors for picking a property are said to be “location, location and location”. Here, we explore the differences between the biggest divide in Tokyo locations: inside versus outside the Japan Railway (JR) Yamanote train line that encloses the central area and is a key route for commuters.

Inside the Yamanote Line loop: The safe bet?

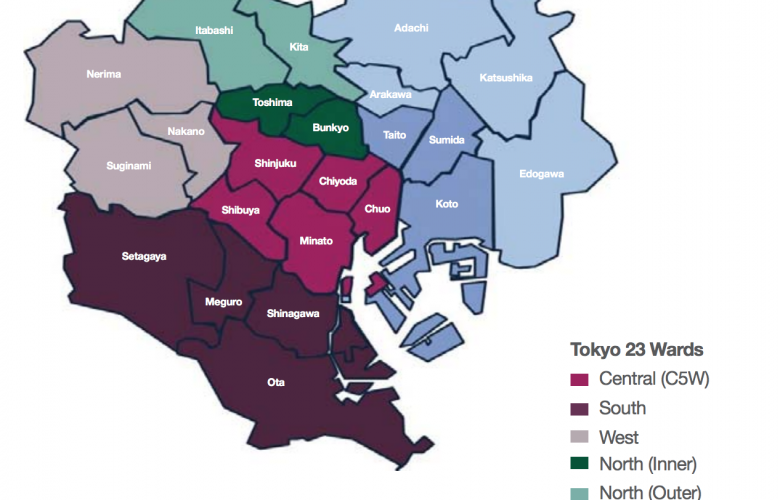

Tokyo is governed as 23 independent wards (23W). The five central wards (5CW), which are either completely located within the loop formed by the JR Yamanote Line or have fringe areas spilling just outside it, are: Shinjuku, Shibuya, Minato, Chiyoda and Chuo wards.

Advantages

In general, these areas are still favoured by most foreign investors. The locations offer the highest convenience and prestige in Tokyo, so they are thought to guarantee the highest occupancy rates for residential property in the capital. In Q2 of 2018, the average occupancy rate stood at 96.1% for 5CW, but all 23 wards together averaged even higher, at 96.9%, according to research by Savills.

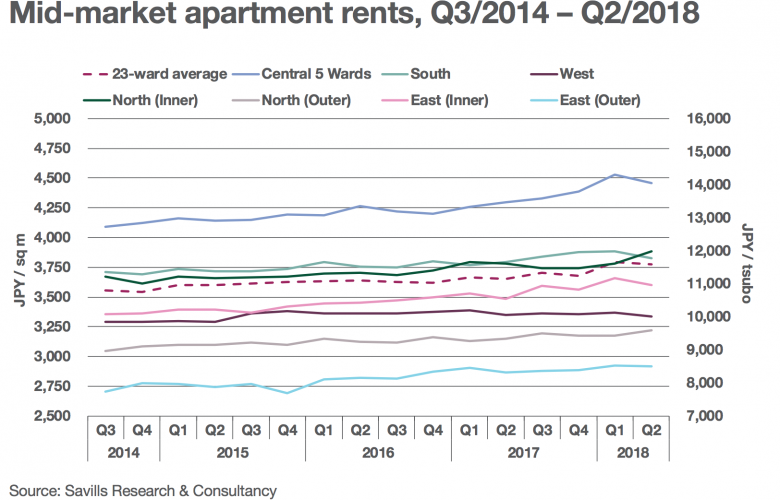

The average 5CW’s rental premium is substantial, with rental income 18.1% higher on average than in the other 18 wards, and on an increasing trend.

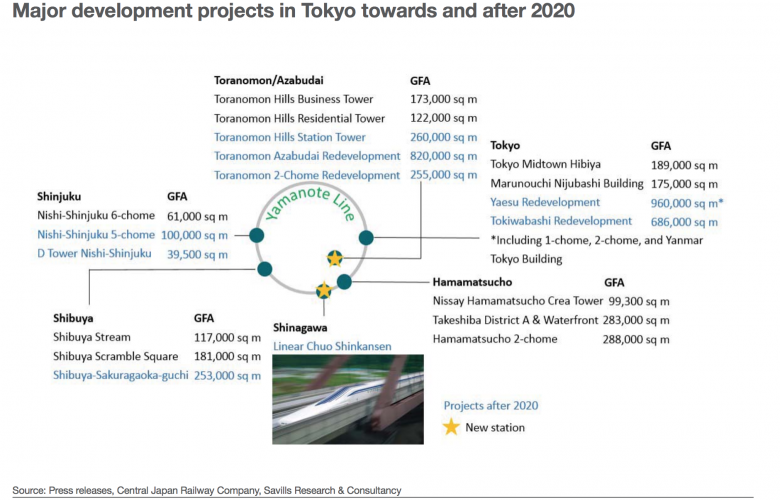

Additionally, the land in the 5CW is among the most valuable in Japan, and has seen noticeable increases in prices over the last few years. According to the Ministry of Land, Infrastructure, Transport and Tourism (LITT), the highest annual increase in 2017 in the 23 wards, at 7.5%, was in Chiyoda Ward, followed by 6.2% in Chuo and 5.2% in Minato. This might give some investors hope for long-term appreciation of their property, especially with the many re-developments planned in the next few years.

Disadvantages

However, these status-symbol properties carry some of the highest price tags in the country: the average price of a unit in Chuo Ward is estimated to be 2,906,212 JPY/m2, and 1,916,846 JPY/m2 in Minato Ward, while all wards outside the Yamanote Line are typically far under a million yen/m2, according to LITT. Not everyone can afford to invest in a unit—let alone a whole building.

Perhaps the biggest drawback of a location inside the Yamanote circle is the ROI (return on investment): while property and land prices have risen massively since the early 2010s, rents have lagged behind. There is an upward trend in rent prices, but generally ROI after tax and other costs is in the lower single digits inside the Yamanote Line loop, at around 2-4%.

While there is a chance of land price increases with central Tokyo properties, one must remain realistic and take the biggest counterweight into account: rapid depreciation of the property itself.

Real estate depreciates fast in Japan, and most of the value is retained in the land only. Adam German, Vice President of Business Development at Housing Japan, explains: "The structural part of real estate in Japan is always a depreciating asset, similar to a car. When we talk about prices going up and down, we are referring to land pricing only. Hence, it is key to purchase in a market where the land prices are rising faster than the depreciation of the structure. Central Tokyo and some other metropolitan areas around Japan are currently rising in prices well enough to offset structural depreciation."

The 5CW mainly cater to the luxury segment, which can make the rapid depreciation of a pricey, brand-new luxury condo very painful.

Outside the Yamanote Line loop: Affordable options with potential for solid ROI

Living outside the Yamanote Line loop has upsides: larger properties are available at lower rates, and might even come with a garden and free parking space (which inside the Yamanote loop can cost as much as a small apartment in a European city per month).

While this may sound like the perfect solution, buyers should beware of locations that could be considered too far outside of Tokyo’s inner circle.

Important considerations

The Japanese capital has long been famous for commuters pressed against the glass of train doors for 90 minutes+ one way, but times have changed. Younger single households, couples and families prefer to live closer to the city these days, and look for locations with the shortest commute routes possible. Therefore, many areas at the outer fringes of the 23 wards are losing popularity—and cannot be recommended for long-term investments as they carry risks to depreciate, become vacant, or in the worst case, become an abandoned property.

On the other hand, some wards and stations outside the Yamanote Line are popular and flourishing. For example, the Ota and Edogawa wards saw an increase in demand for rental property this year.

Investing in well-selected real estate outside the Yamanote Line can, in some cases, reap ROI of 5-7% after tax and expenses—twice as much as many inner city properties. Why is this? The land is much cheaper, as described above, but the rent is only somewhat lower, leaving investors with a favourable margin.

However, investing here is by no means a no-brainer. Potential buyers are advised to partner with an experienced realtor and to do their due diligence.

What to look out for

Some train stations that were previously regarded as part of a high-end neighbourhood have recently lost their luster, e.g. the Denenchofu area in Ota Ward. Still regarded a luxurious expat neighborhood, the area is facing a population decline, which is a sign that potential land and property price drops might follow.

It's important to do your research in the form of market reports and visit the areas. A busy train station is a good sign of a lively neighbourhood that bears a lower risk of vacancy rates.

Make sure the station is within 30 minutes of central Tokyo and has all the conveniences a Tokyoite would need: supermarkets, restaurants, doctor’s offices—a local hospital is an even bigger plus, as are schools and universities, and also leisure spaces like a decent park.

Properties further than 10 minutes' walk from the station have a higher vacancy risk, as a rule of thumb. Finally, reinforced concrete buildings are usually more popular than wood structure apartments—and also tend to have a longer lifespan.

Key takeaways

Ziv Nakajima-Magen, partner at Nippon Tradings International, summarises the situation: "With the bottoming out and reversal of the 25-year deflationary cycle, rental returns in Tokyo are currently very low—if you're purchasing an investment property, be aware that capital growth is not a given, and shouldn't be a strategy to bank on. Consider more suburban properties, or satellite cities, which will provide better annual yields than central city properties. You're far from guaranteed to sell at a profit, if and when you do sell, again, so the same caveat applies—if possible, try to consider more suburban properties, which will cost less, and also allow you to get more living space for the same amount of money spent."

Properties with a sizable return on investment can be found more frequently outside the Yamanote Line, and at lower prices. That said, buyers must be real estate savvy before locking in their money. While they can expect good monthly returns, land prices rise slower and appreciation is unlikely outside the 5CW; and the biggest risk factor to check for is vacancies.

Click here to see the Savills research report.

By Mareike Dornhege

Similar to this:

Real estate growth in central Tokyo: Trends to watch

Freehold vs. leasehold: What types of land ownership are available to foreign residents in Japan?

Guide to finding a real estate agent in Tokyo