On June 1st, Kenbiya announced their Nationwide Residential Income Property Market Trend report for May, 2022.

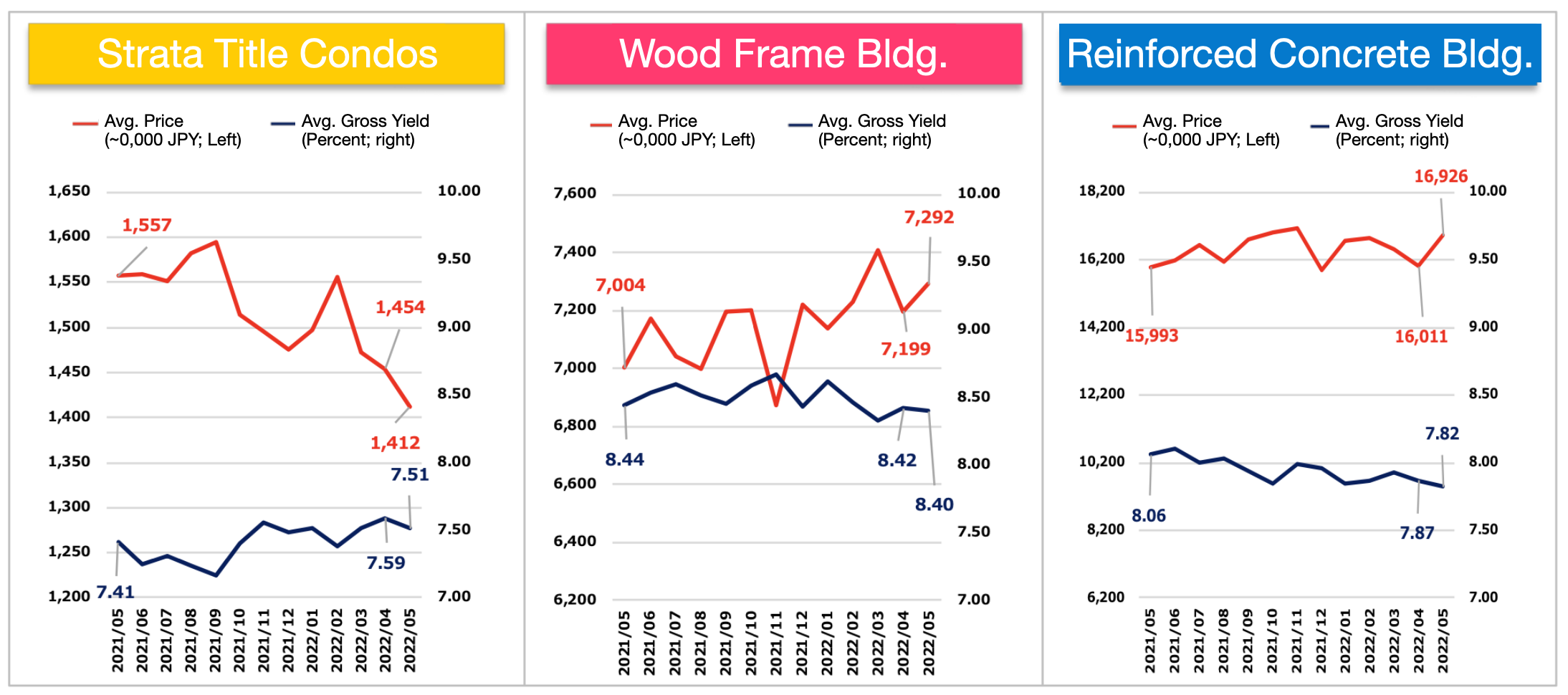

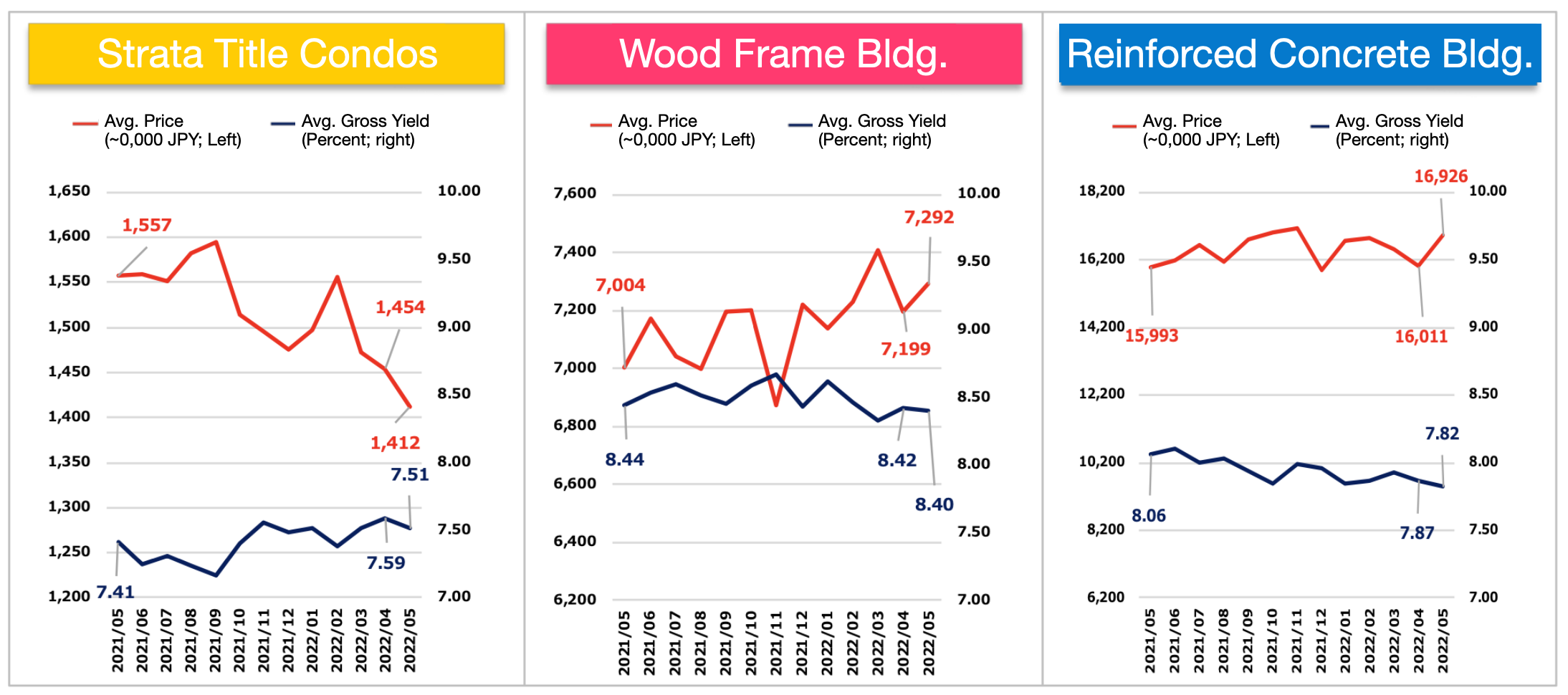

The report compiles average property prices and average gross yields for nationwide residential income producing properties (strata title condos, wood frame residential buildings, and reinforced concrete multi-family buildings) that were newly registered on Kenbiya's property portal website.

The numbers presented are nationwide averages according to the data Kenbiya has access to within its own property portal system and as such, should be perceived as indicators of trends and not as any type of guarantee of yield or price.

It is also important to note that Kenbiya’s data are asking prices from sellers and not transaction prices.

Always consult with a licensed realtor for property specific needs.

Japan Nationwide Average Residential Income Property Yields

Source: Kenbiya

Source: Kenbiya

The average price of investment strata title condos fell for the third consecutive month to 14.12 million yen (down 2.89% from the previous quarter). Gross yields fell for the first time in three months to 7.51%, down 0.08 points Year-on-Year (YoY).

The average price of a multi-family wood frame building was 72.92 million yen (up 1.29% YoY). Average gross yields dropped to 8.40% (down 0.02 points YoY).

The average price of a multi-family reinforced concrete building rose for the first time in three months to an average of 169.26 million yen (up 5.71% YoY). Gross yields were averaged at 7.82% (down 0.05 points YoY).

Further Reading

Kenbiya Nationwide Residential Income Property Market Trend Report for May, 2022 (Japanese only; June, 2022)

Source: Kenbiya

Source: Kenbiya