On November 25th, Savills Investment Management released their Real Estate Outlook 2022 report covering global commercial property markets ranging across office, logistics, retail, real estate debt and alternative investments.

Alternative investments as defined by the report includes multifamily property.

REthink Tokyo has read through the 43 page report and highlighted points where Japan property was mentioned.

Key Messages - Asia Pacific (Page 9)

Japanese multifamily homes will see continued resilience, especially in the key metropolitan areas that benefit from both lifestyle aspirations and employment opportunities.

We think repriced hotel assets in markets with deep domestic travel demand – such as Australia, New Zealand and Japan – offer a structural inroad into post-pandemic hospitality.

Homing Instincts: the Living sector comes of age (Page14)

We see Living sectors as largely immune to the detrimental impacts of technology – clearly not the case for retail and offices.

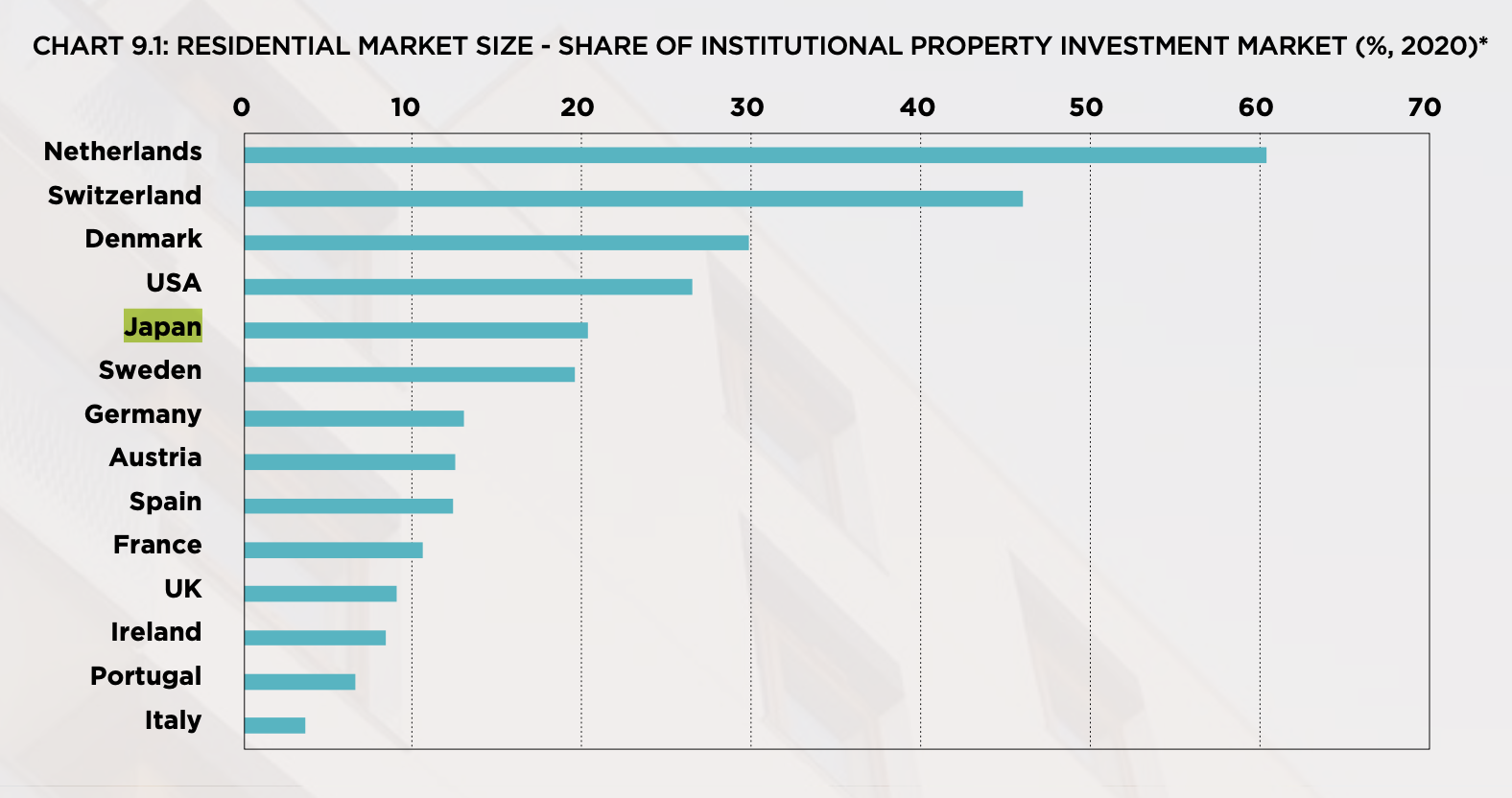

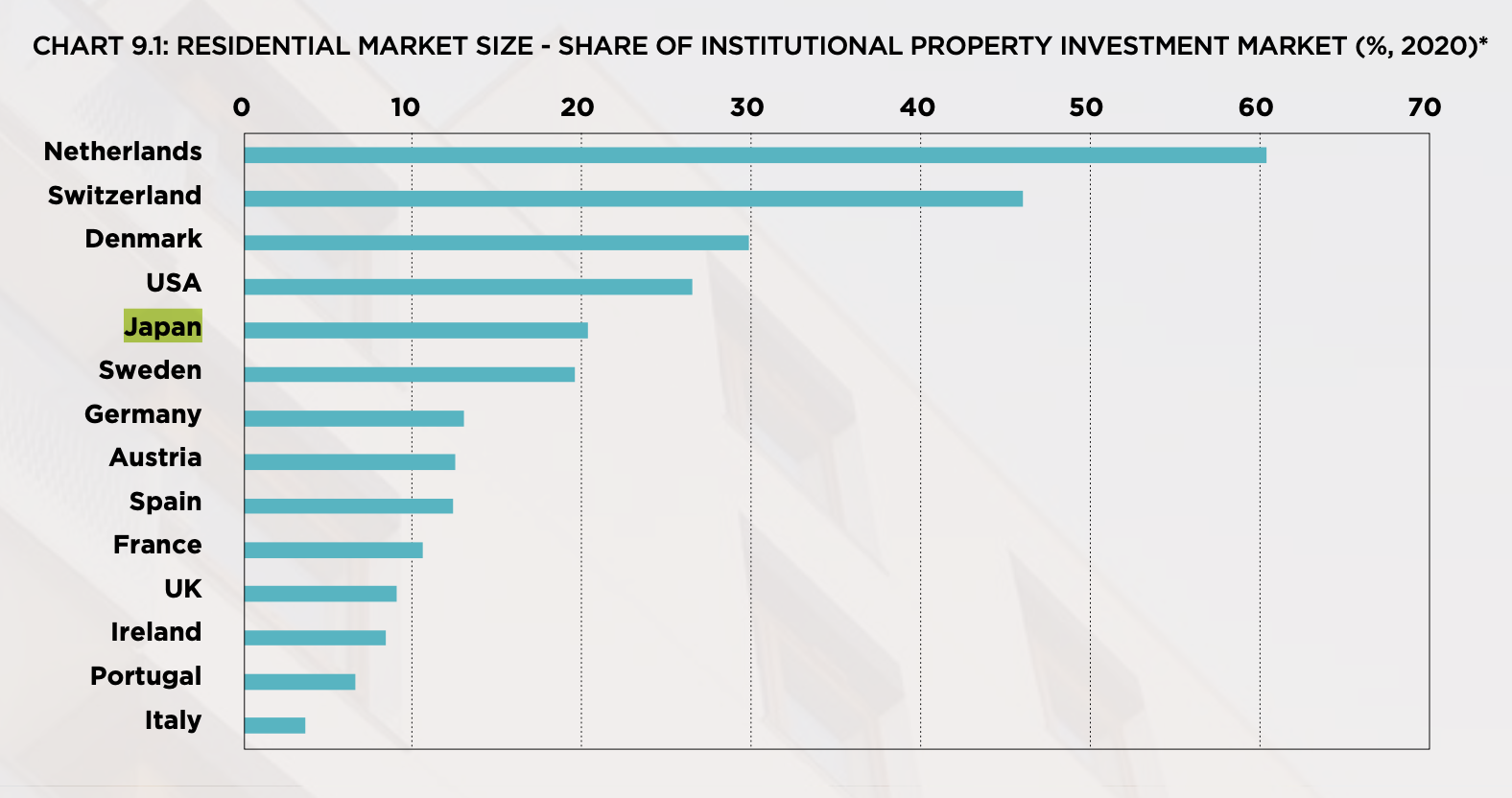

Surveys of investor preferences, including INREV and others, show high interest in the sector, so the challenge is now around the pricing of core assets and their scarcity.

Source: Savills Investment Management

The tailwinds boosting Japan’s multifamily housing sector (Page 35)

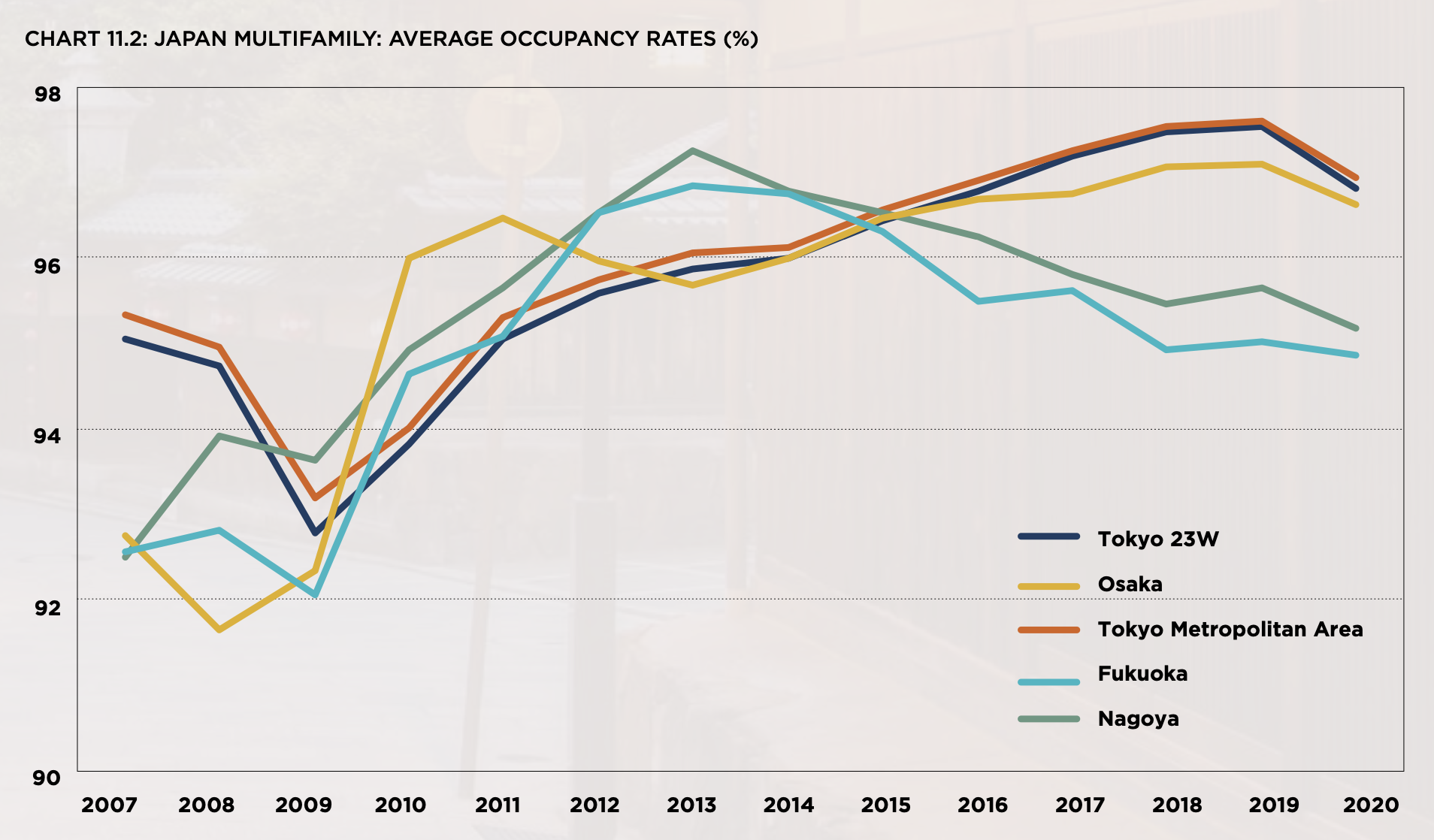

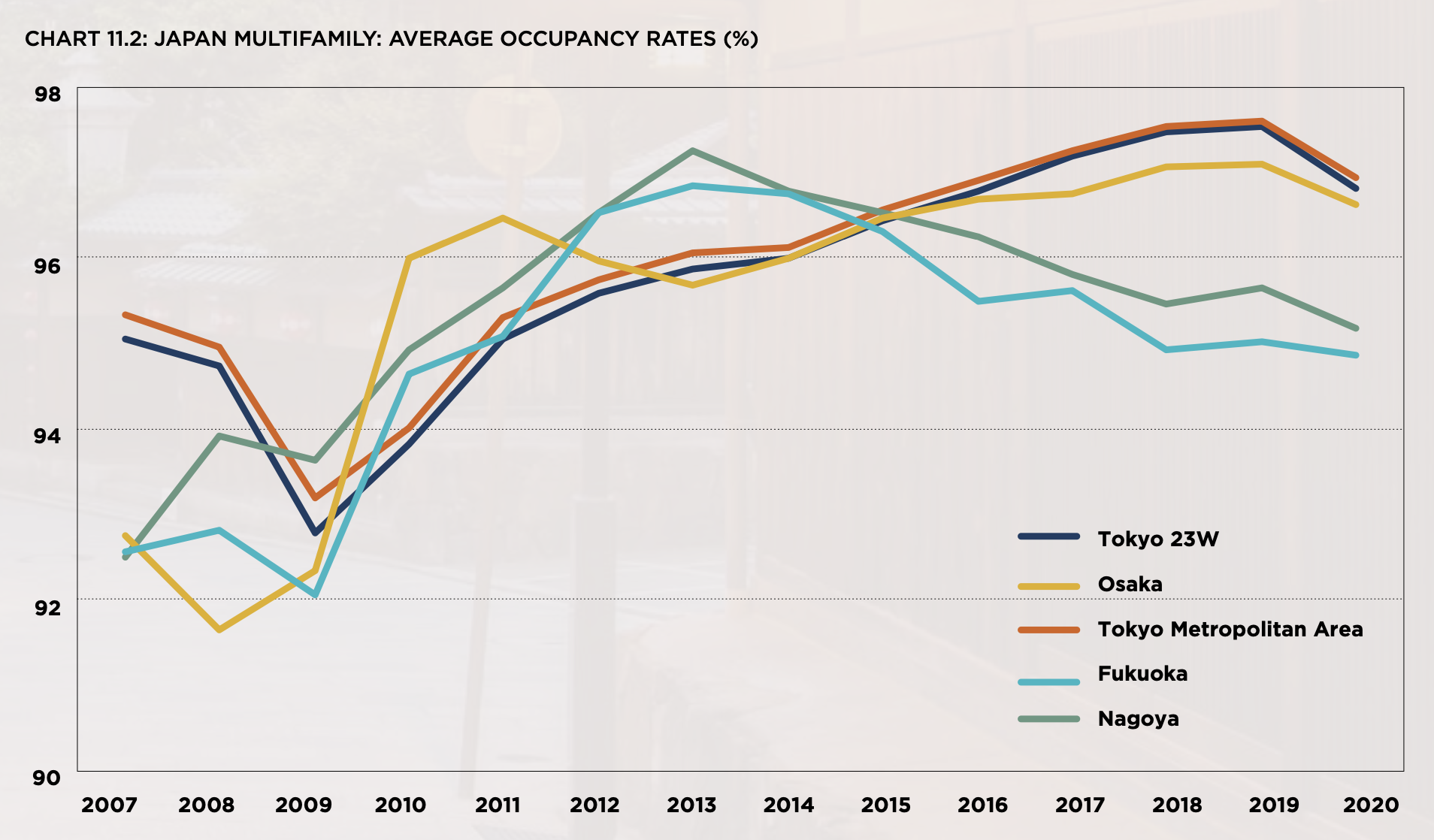

The Japanese multifamily residential sector enjoys robust fundamentals due to its scale, stability and liquidity throughout the market cycle.

The sector provides a defensive income profile and consistently high occupancy rates above the 90% threshold, while benefiting from supportive demographic trends.

Source: Savills Investment Management

Ongoing in-migration into Greater Tokyo and the major cities has driven population growth; between 2010 and 2021, the number of residents in Tokyo’s 23 central wards increased by 9.6%. Growth was 3.5% in Osaka, 3.1% in Nagoya, and 11.4% in Fukuoka.

Greater Tokyo is home to some 37 million residents and is projected to remain the largest urban agglomeration globally over the next decade.

Will Johnson, Director of Savills IM Japan and author of this section of the report. Photo from LinkedIn.

Data by the Japan Statistics Bureau also shows that urban occupiers typically prefer to rent: 52% of dwellings were rented in Tokyo’s 23-wards and as many as 60% rented in Fukuoka, according to the latest survey in 2018.

We anticipate the multifamily sector in 2022 will see a distinct uptick in leasing activity due to latent demand among individual residents and corporates as recruitment and workplace strategies begin to normalise.

This, along with restricted supply, should translate into higher achievable rents, particularly in more central locations. Meanwhile, the weight of capital looking to flow into this sector is expected to maintain downwards pressure on cap rates.

Further Reading

Savills IM Real Estate Outlook 2022 full report access (November, 2021)

Savills IM increases Japan Residential Portfolio by $218 million (REthink Tokyo; July, 2021)

CBRE Report Highlights Robust Japan Multifamily Condo Market (REthink Tokyo, September, 2021)