The Urban Land Institute (ULI) together with PricewaterhouseCoopers (PwC) released their Emerging Trends in Real Estate Asia Pacific 2022 report earlier in November.

REthink Tokyo has reviewed the 60 page report and highlighted pertinent sections about Japanese residential property.

While the report was written with institutional investors in mind and covers not only residential but office, hotel, logistics, warehouse and data centre sectors, even the individual investor or homeowner’s property could see values affected by the same influences that institutional owned properties are looking out for over the next year.

How the Report was Created

According to the report, the “Emerging Trends in Real Estate Asia Pacific 2022 reflects the views of individuals who completed surveys or were interviewed as a part of the research process for this report.

The views expressed herein, including all comments appearing in quotes, are obtained exclusively from these surveys and interviews and do not express the opinions of either PwC or ULI.

Interviewees and survey participants represent a wide range of industry experts, including investors, fund managers, developers, property companies, lenders, brokers, advisers, and consultants.

ULI and PwC researchers personally interviewed 101 individuals and survey responses were received from 233 individuals.”

Japan Key Themes (Page 28)

Historically, Japan has had strong appeal among foreign real estate investors due to its reputation for stability, liquidity, and cheap debt.

In addition, with the exception of the inbound tourism sector, the Japanese economy remains quite self-contained. Domestic demand accounts for 95 percent of the retail market and some 91 percent of the accommodation market, making it less exposed to threats posed by global travel bans, foreign imports, and supply chain constraints.

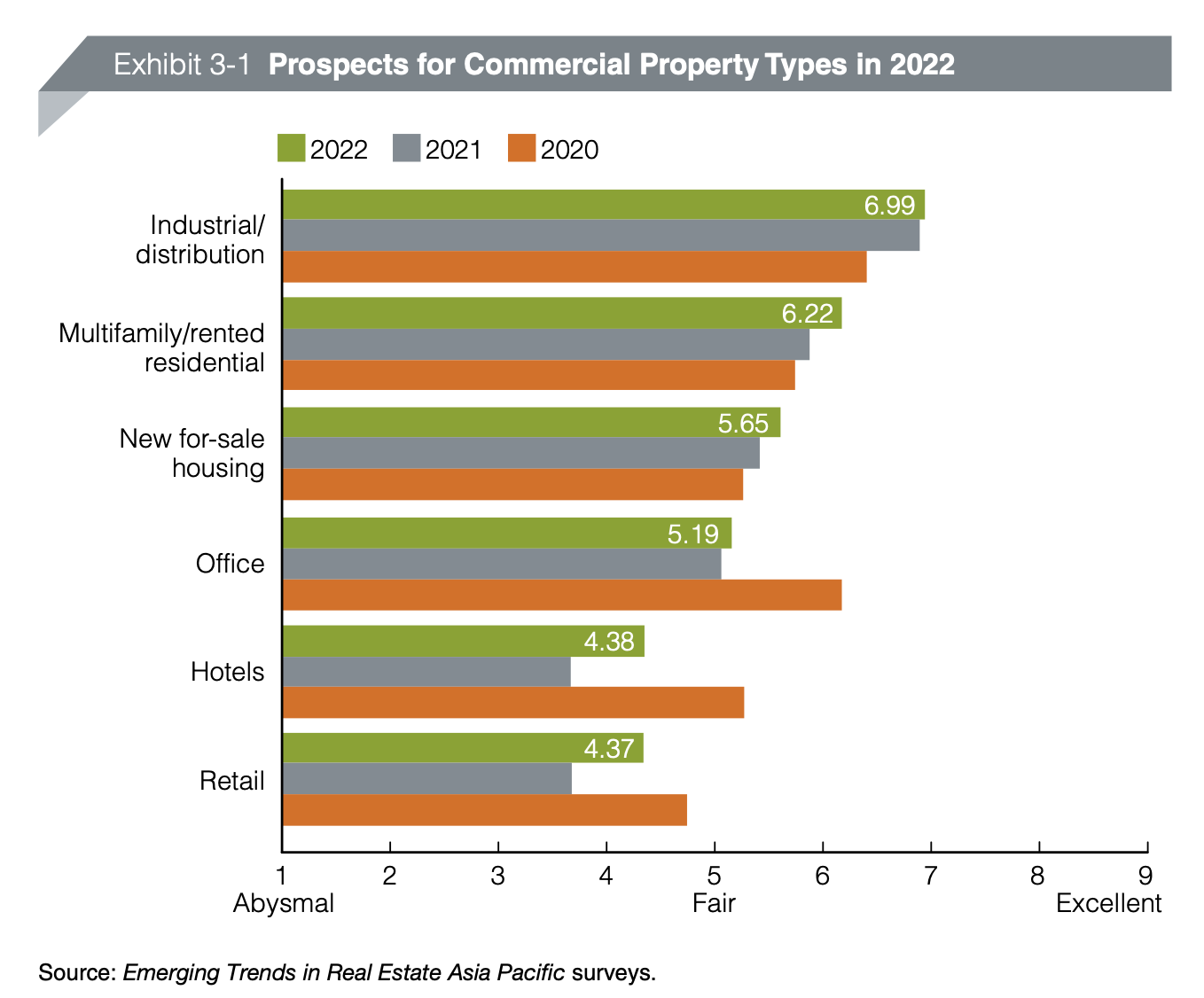

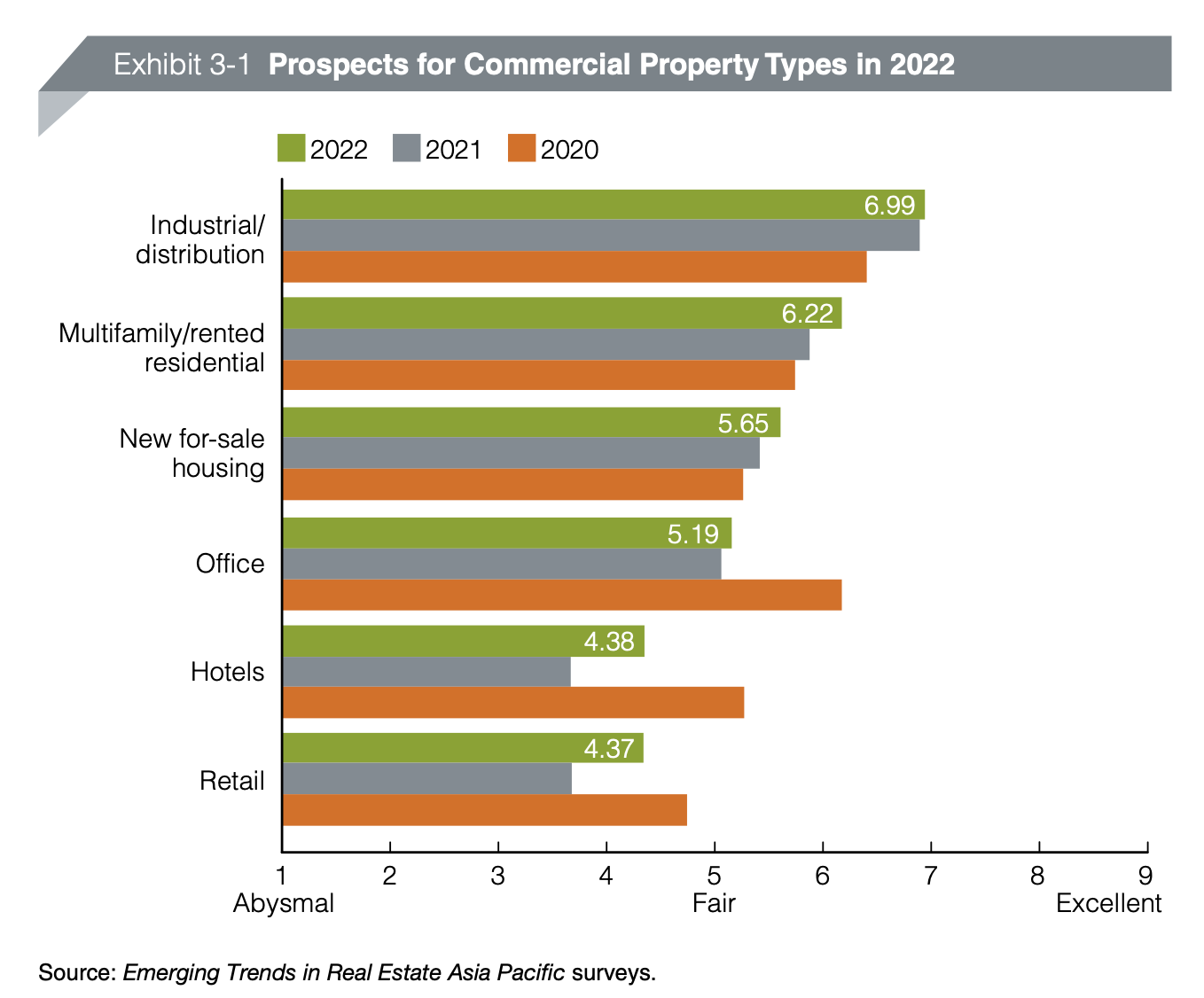

Recently, Japan’s build-to-rent residential sector has become a magnet for foreign funds. Once unfashionable, multifamily assets caught the eye of high-profile institutional investors a few years ago as they cast about for long-term, low-risk places to park capital.

As the only mature multifamily market in the Asia Pacific, Japan ticks those boxes because it is considered to have low leasing risk as well as potential for rental increases.

Although cap rates for Japanese multifamily assets have steadily compressed over several years (from around 5 percent to current levels of 3 percent or less), competition to buy portfolios is stronger than ever.

According to one fund manager, “If you look at European investors, and where residential pricing is in Europe, they still think that even at a 2.5 or 2.75 cap rate, residential looks pretty attractive in Japan, particularly given low borrowing costs.”

Further compression therefore seems likely.

Property Type Outlook - Residential (Page 44)

In Japan, cap rates as low as 3 percent have therefore proved acceptable to institutional buyers, especially when paired with Japan’s ultra-low-cost borrowing (i.e., 1 percent or under), levered at 60 percent–plus.

Investors also expect to eke out incremental gains in other ways—be it yield compression, rental increases, value-add of various kinds, or even conversion to co-living facilities.

With competition tight and product hard to source, investors have turned to forward purchases as a way to quickly build platforms, increase returns, and address supply shortages.

In the process, they are often assuming lease-up risk as a means to boost income.

While this has become a favoured play for foreign funds in Japan, however, the risk/return prospects have been questioned. According to one Tokyo- based fund manager, aggressive underwriting of both pricing and rents leave little margin for error.

“One of the big issues for residential is [high] tenant turnover,” he said. “We’re hearing they’re having trouble finding tenants— downtime can be well over a year, and then you have your cost to get tenants in. So if you’re buying these forward commitments, and you underwrote this stuff a year and a half ago at, say, 3 to 3.5 [percent cap rate], and your rents are now down 20 percent and you’re also having trouble leasing it up, you could easily be in the 2.0, 2.5 percent range very fast, and if you’re borrowing at 70 percent [LTV] you’d be in negative net cash flow territory relatively quickly.”

One reason for rising leasing risk is that tenant preferences are evolving. With people now more likely to spend time at home, build quality is increasingly important, as is apartment size, with many tenants looking for a bigger footprint or an extra room to use as a home office.

Property Type Outlook - Hotels: Japan Targeted (Page 48)

According to a fund manager in Singapore: “Pre-COVID, the Japanese were seeing a very steep curve in visitor arrivals, and what with its infrastructure and other general offerings, we were very bullish long-term on Japan hospitality.

It also has the benefit of a big domestic population, so that gives it some level of cushion, but it is missing out on that inbound market.

We’re launching a new Japan hotel fund, probably a club, that will be targeting hotels in Japan looking for more of that value-add type proposition where owners are maybe a little deprived of capital.”

Japan is also interesting for investors who want to arbitrage an imbalance of stock serving different subsectors. According to one local investor, “Performance has been dramatically different between luxury hotels and budget hotels. There’s been an alarming increase in [the number of] budget hotels, which will make it nearly impossible for their revenue structures to recover.

But we believe this presents a business opportunity in 2022 and later for repositioning assets, for example, as for-sale condominiums.”

Further Reading

Emerging Trends in Real Estate Asia Pacific 2022 Full Report (ULI & PwC; November 2021)