‘The most expensive city in the world.’ ‘An apple in Tokyo will cost you as much as a meal elsewhere.’

We have all heard it before. While there was a time when the Imperial Palace in the Japanese capital was valued to be worth as much as the State of California, these rumours are no longer true since the economic bubble burst more than two decades ago. Yet, rumours die hard. Depending which criteria you apply, Tokyo has long been overtaken as the most expensive city in the world by places like Singapore or Geneva.

Here we take a look at some key numbers for real estate in the Japanese capital — like average rent, land price and rental return — in comparison to capitals and charismatic cities around the world.

1) Tokyo apartments are bigger than you might have thought

The average square metre price in Tokyo compares favourably to its cohorts around the globe. In fact, Sydneysiders and Tokyoites allocate only around 30% of their income on rent, while 40% is common in London, Paris, and NYC.

Average price of a square metre of real estate in USD:

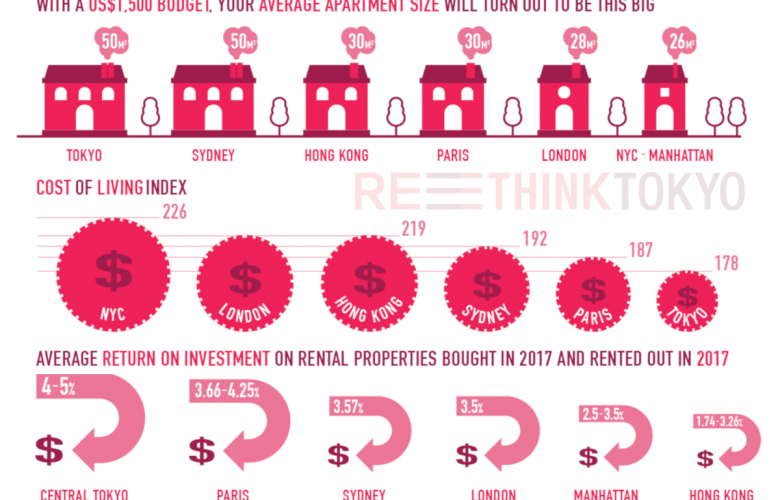

With a US$1,500 budget, your average apartment size could be:

Data source

2) The cost of living in Tokyo has decreased since the bubble, but risen elsewhere

Expatistan, which compares cost of living around the globe, came up with a cost of living index to illustrate global differences. One-hundred (100) indicates the average cost of living in a city worldwide (which just so happens to equal the cost of living in Prague). Anything below or above shows the deviation from this. To our surprise, rent, food, supplies and transport in Tokyo were more affordable than generally thought.

Cost of index living (high to low)

However, some of these pricey cities are also populated by people with some of the highest average salaries worldwide. Tokyo falls into the middle on this scale:

Average monthly salary in USD:

3) The rental yields are worth an investment

Rental income in Tokyo has decreased with the recent appreciation of property thanks to Abenomics and the upcoming 2020 Olympics, and is contrasted by currently stagnating rents. Yet, Tokyo rental ROI still outperforms compared to other developed megacities:

Average return on investment on rental properties bought in 2017 and rented out in 2017 (the returns may differ for properties bought at different times):

4) Land prices are high

Land prices in central Tokyo are on an unbroken ascent, putting the Japanese capital in the midsection of the ranking. However, land gets much cheaper outside the 23 wards.

Land prices (USD) per square metre:

By Mareike Dornhege

Similar to this:

Land prices of Japan in 2019

Over a quarter of nationwide apartments on the market are over 30 years old and based in Tokyo, sources say

Going solo: The Japanese preference for living alone