On January 5th, Kenbiya announced the December 2021 edition of their monthly nationwide investment property market trends.

Kenbiya operates a Japanese language property portal dedicated mainly to residential investment property and the data they quote comes from property prices and gross yields entered into their system by advertising agents.

The monthly report focuses on three property types; strata title condos, wood frame whole building apartments, and reinforced concrete whole building condominiums.

It is important to note that these are nationwide averages and address specific property will vary greatly. This data is presented as trend illustration data only. Always consult with a licensed real estate professional for property specific needs.

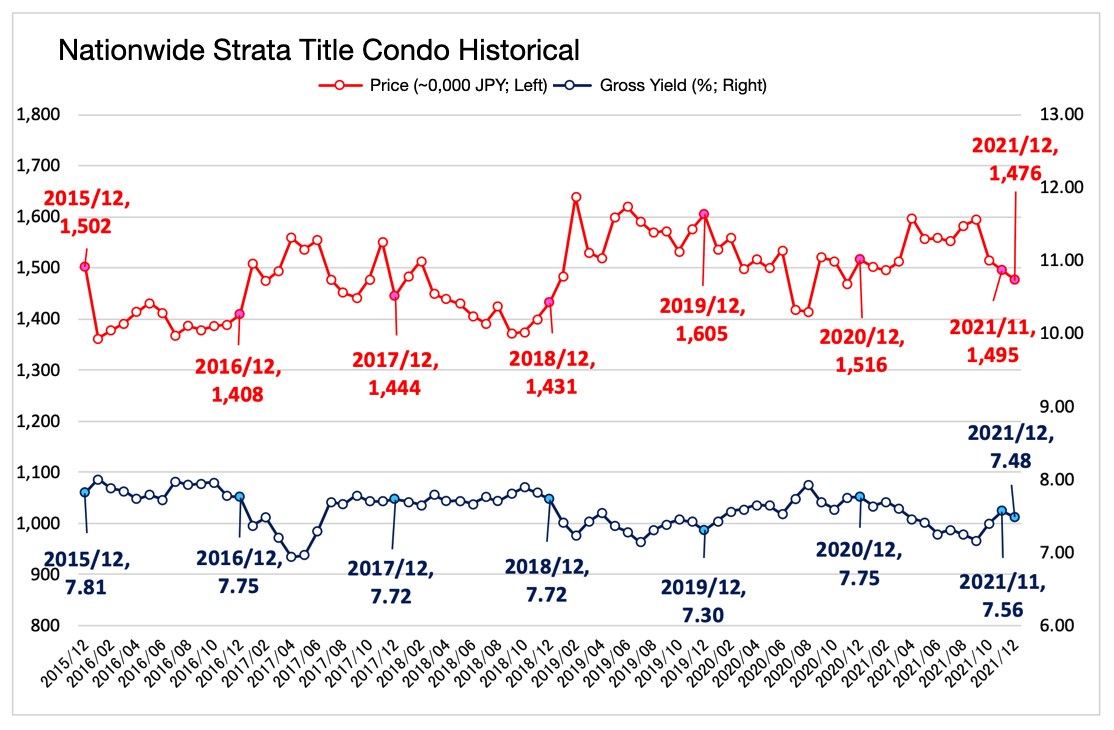

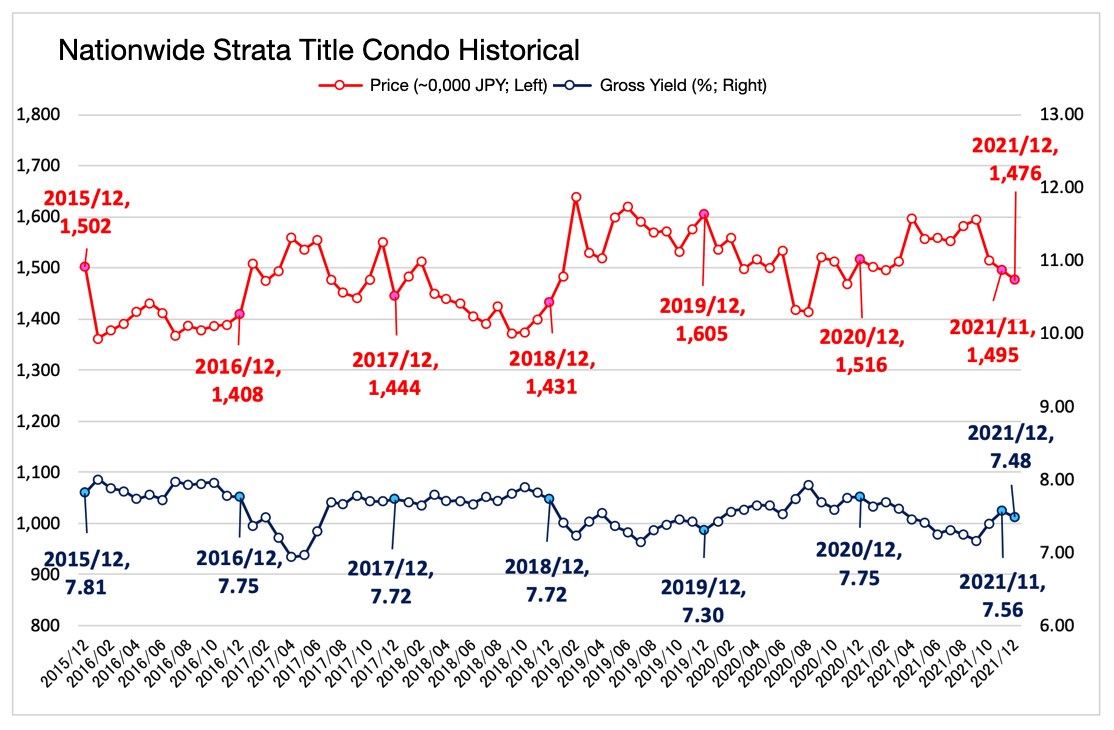

Strata Title Condos

Source: Kenbiya

The average price of strata title condos fell for the third consecutive month to 14.76 million yen, down 1.27% from the previous month. The average gross yield fell for the first time in three months to 7.48%, down 0.08 points from the previous month.

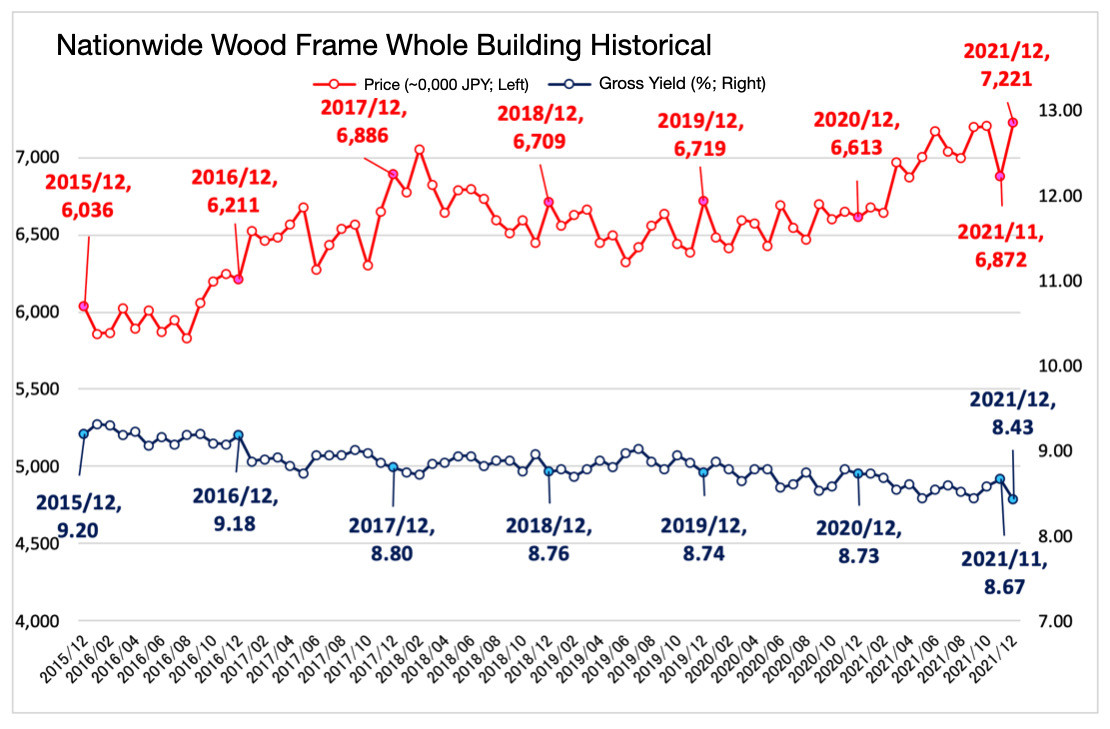

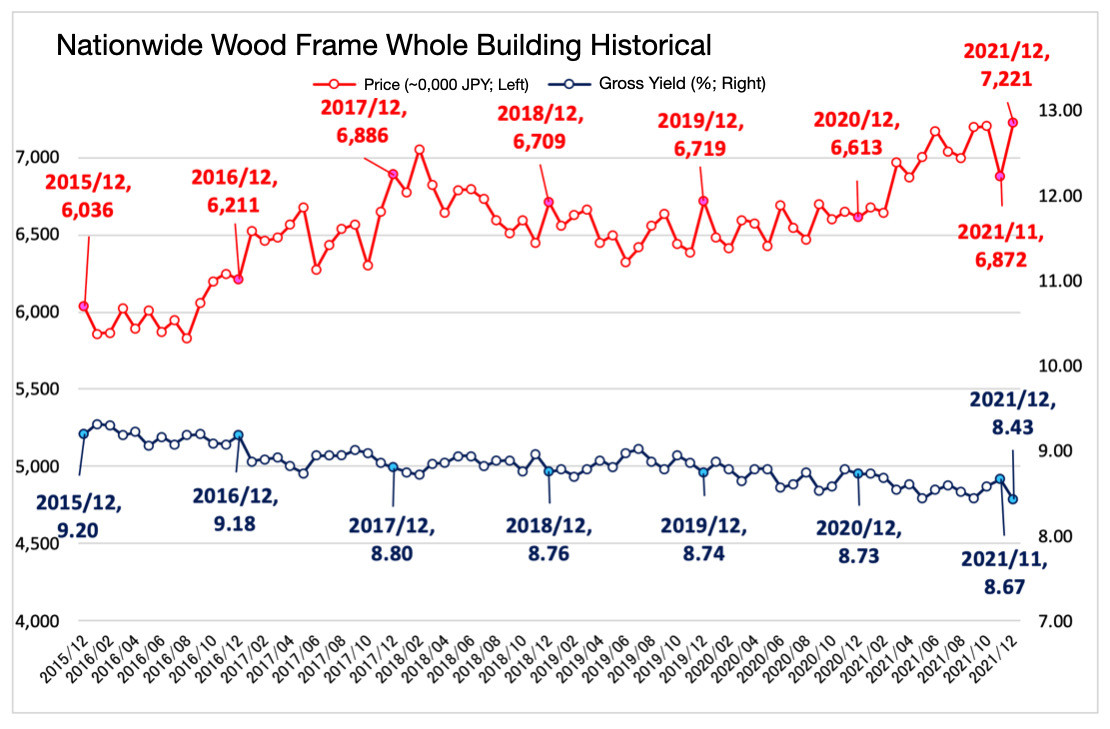

Wood Frame Whole Buildings

Source: Kenbiya

The average price of a wood frame whole building rose for the first time in two months to 72.21 million yen, up 5.08% from the previous month. The average gross yield fell for the first time in three months to 8.43%, down 0.24 points from the previous month.

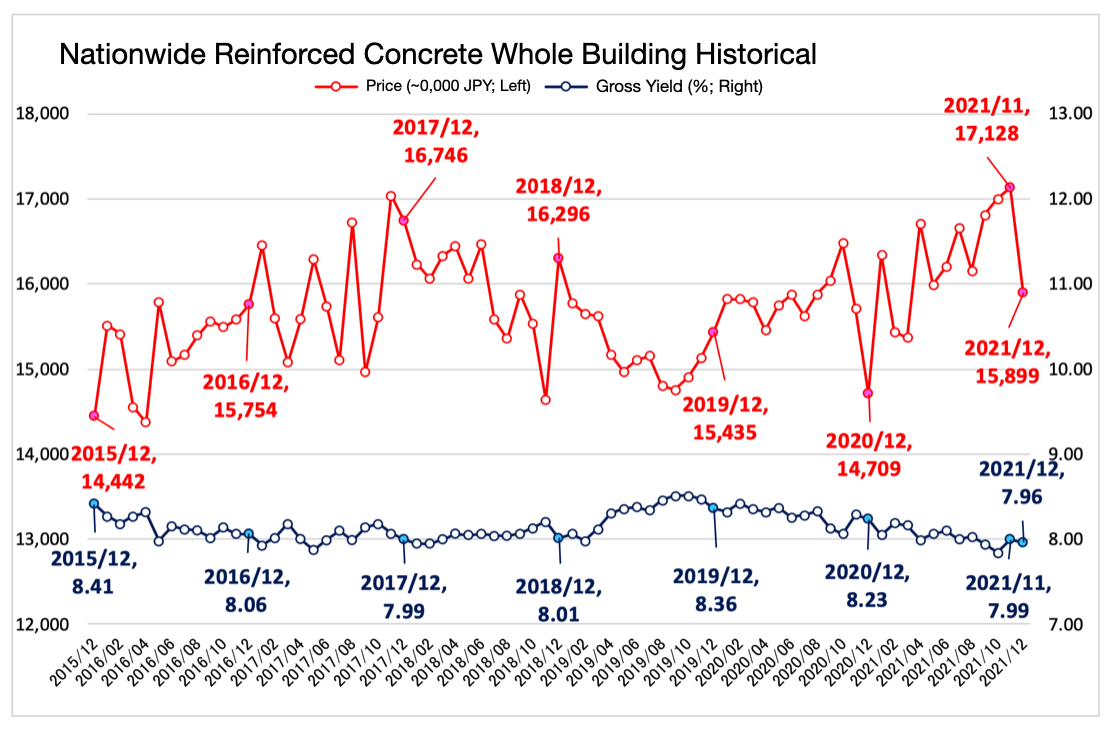

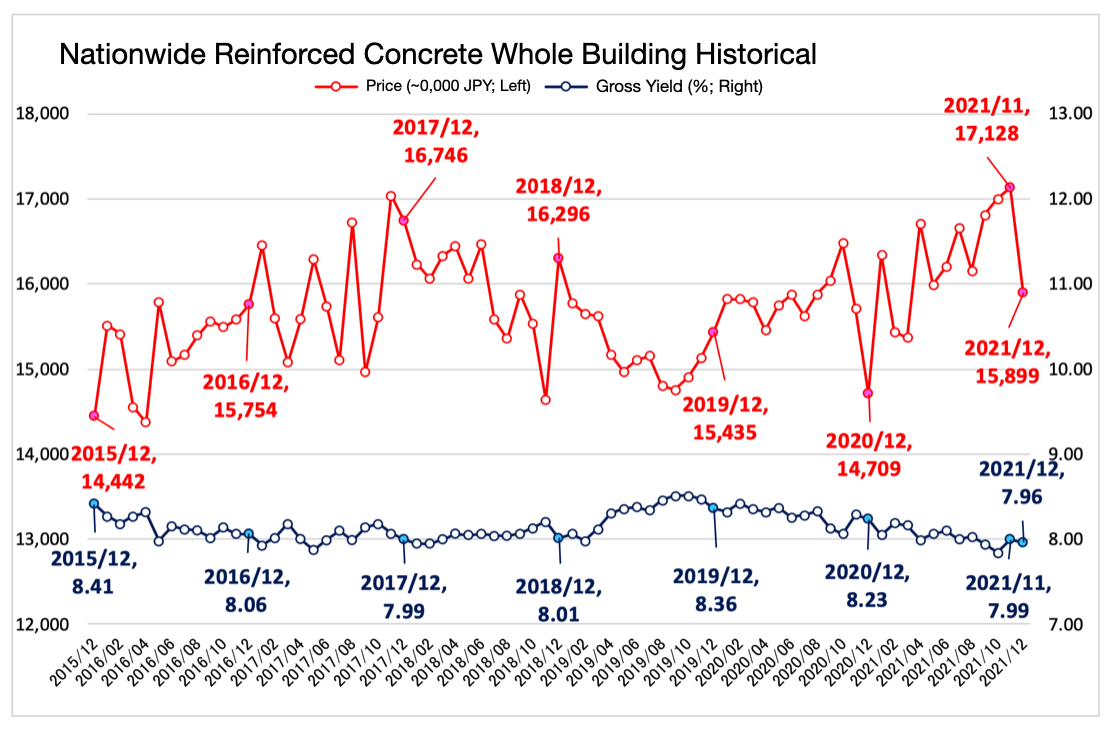

Reinforced Concrete Whole Buildings

Source: Kenbiya

The average price of reinforced concrete whole buildings fell for the first time in four months to 158.99 million yen, down 7.18% from the previous month. The average gross yield declined to 7.96%, down 0.03 points from the same time frame.

Further Reading

Kenbiya Monthly Nationwide Investment Property Market Trends Report December 2021 Edition (Japanese only; January, 2022)