On November 8th, Hetiman announced their purchase of 329 multifamily units across 8 buildings in the submarkets of Tokyo. The acquisition price was undisclosed.

All assets are brand new with some completed and others to be completed by the end of 2021.

According to Brad Fu, Head of Acquisitions of Asia-Pacific Private Equity, “We are pleased to acquire this high-quality and well-located Tokyo multi-family portfolio. We are seeing strong lease-up momentum and anticipate that we will see long-term resiliency in the residential sector underpinned by sustained urbanization and limited net new supply in Tokyo.”

Brad Fu, Heitman's Head of Acquisitions of Asia-Pacific Private Equity

Japan multifamily portfolio purchases saw bullish demand in early 2021 with portfolio transactions totalling approximately ¥128 billion, and with the exception of Heitman's move into the market, that demand has waned as the second half of the year approaches a close.

In December, 2019, Tatsuya Kaneko, head of research and consultancy at Savills Japan accurately read market sentiment by saying, “Japanese multifamily residential remains very popular with overseas investors. In fact it might be the most popular sector. At this late stage in the cycle, mid-market multifamily residential is seen as very stable and defensive. Even after the global financial crisis, both rent and occupancy fell by only 10%.”

Indeed, while this is Heitman’s first foray into Japanese residential property, the segment has been on the company’s radar since 2019.

Source: Heitman, October, 2019

Source: Heitman, October, 2019

What makes Japan's residential investment property attractive to institutional and retail investors is the relatively safe rental market.

Partly contributing to this perception is that each lease is underwritten by a third party guarantor company that covers tenants in case they are unable to make their rent payments.

These guarantor companies cover lost rent, eviction legal costs and restoration of the property to the original condition post eviction.

Guarantor companies are a tenant born expense with the premium being paid by the tenant along with other leasing costs like deposits, brokerage fees and first month’s rent.

However the choice of which guarantor company to use for the building is the owner’s decision.

Additionally, Japan’s famously low unemployment rate paired with strict labour contract laws that make it difficult for companies to lay off full time workers even in the most dire of economies is another attractive benefit for this asset segment.

Gordon Black, Heitman Senior Managing Director and Portfolio Manager

Gordon Black elaborated “We identified Japan multifamily as a target for our initial global strategy’s portfolio construction due to its delinked demand drivers and cash flows less correlated to economic conditions.”

Further Reading

Savills 2021 Q3 Residential Leasing Report (October, 2021)

A Demographic Future: How ongoing structural shifts fuel value-added opportunities across the Asia Pacific region (Heitman; October, 2019)

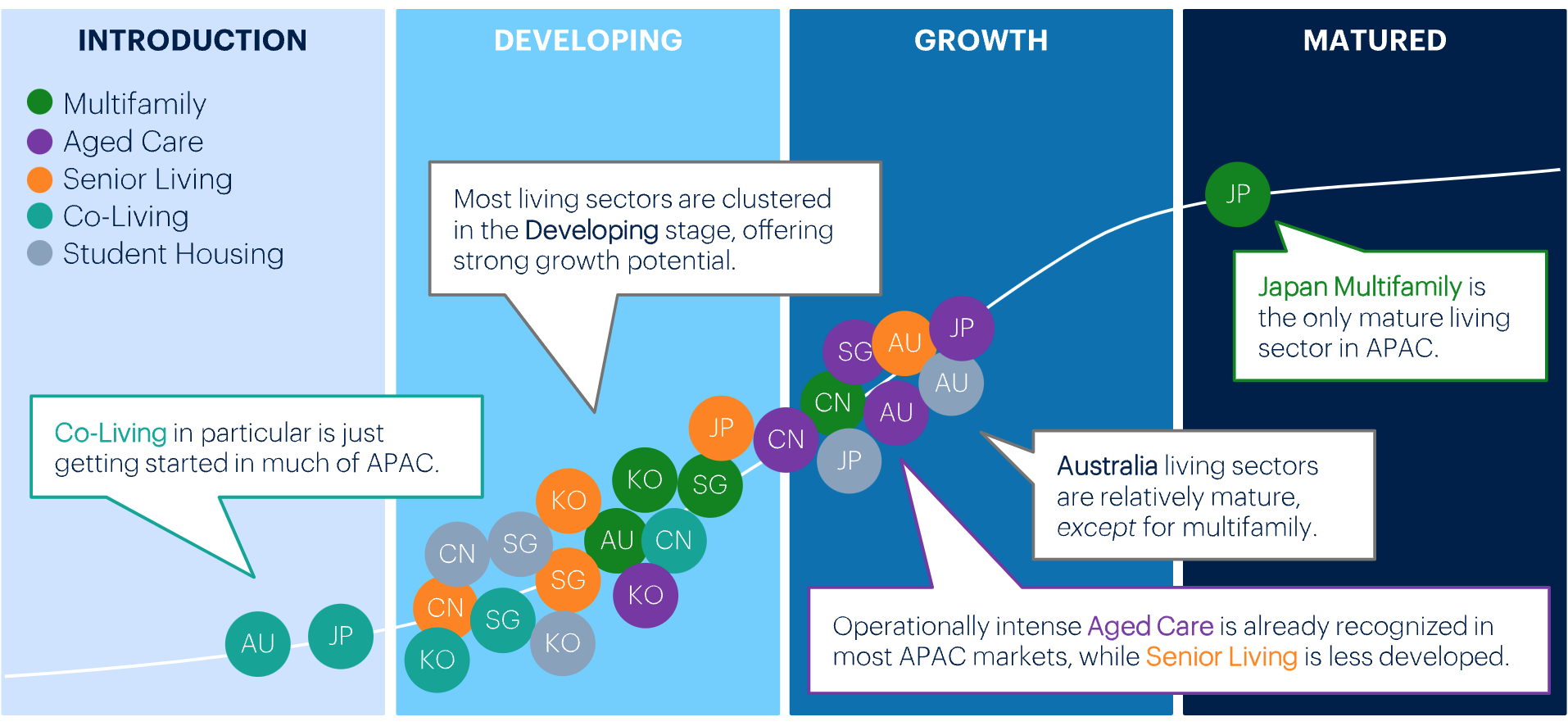

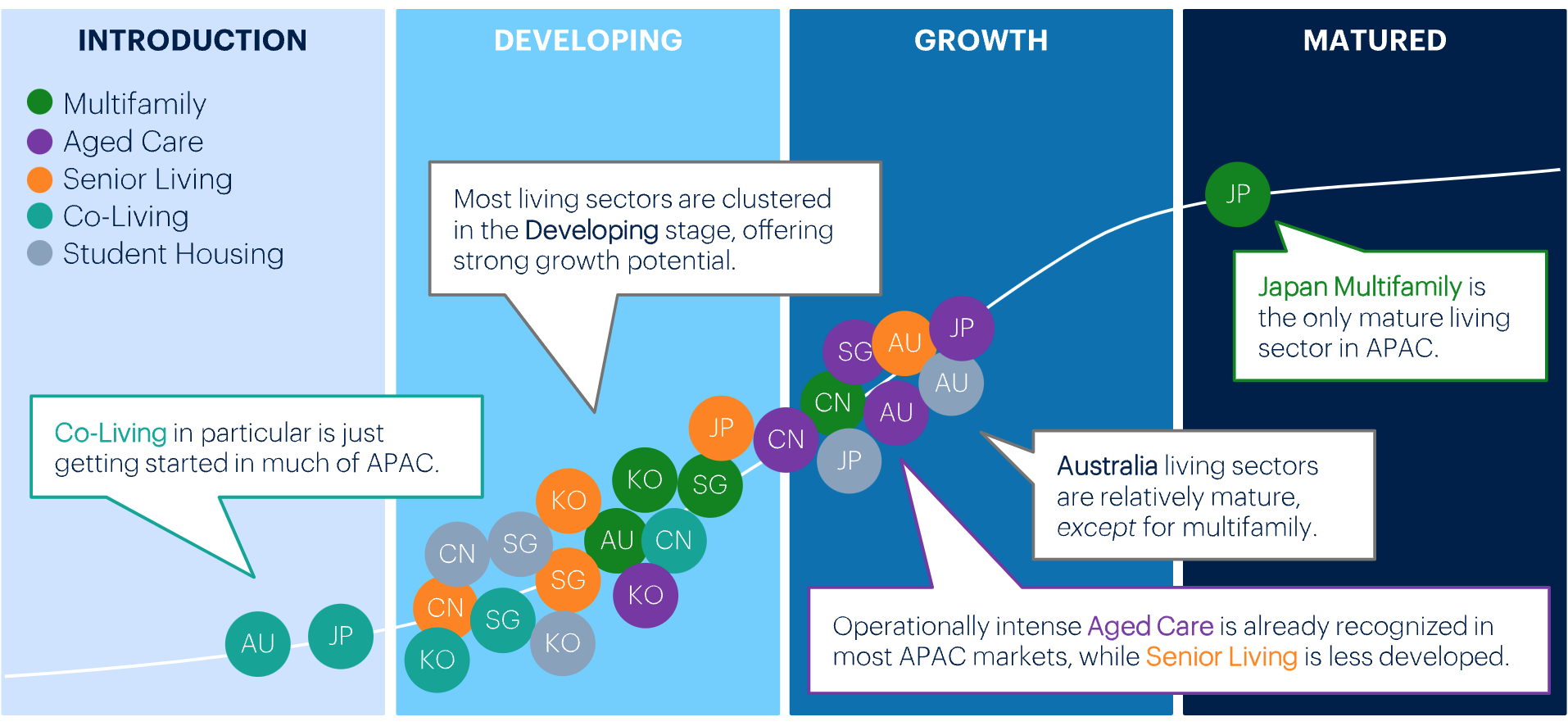

Source: Heitman, October, 2019

Source: Heitman, October, 2019