UBS released its Global Real Estate Bubble Index for 2021 in October.

The purpose of the report is to measure the affordability of residential real estate in major cities globally, which includes sections on Tokyo.

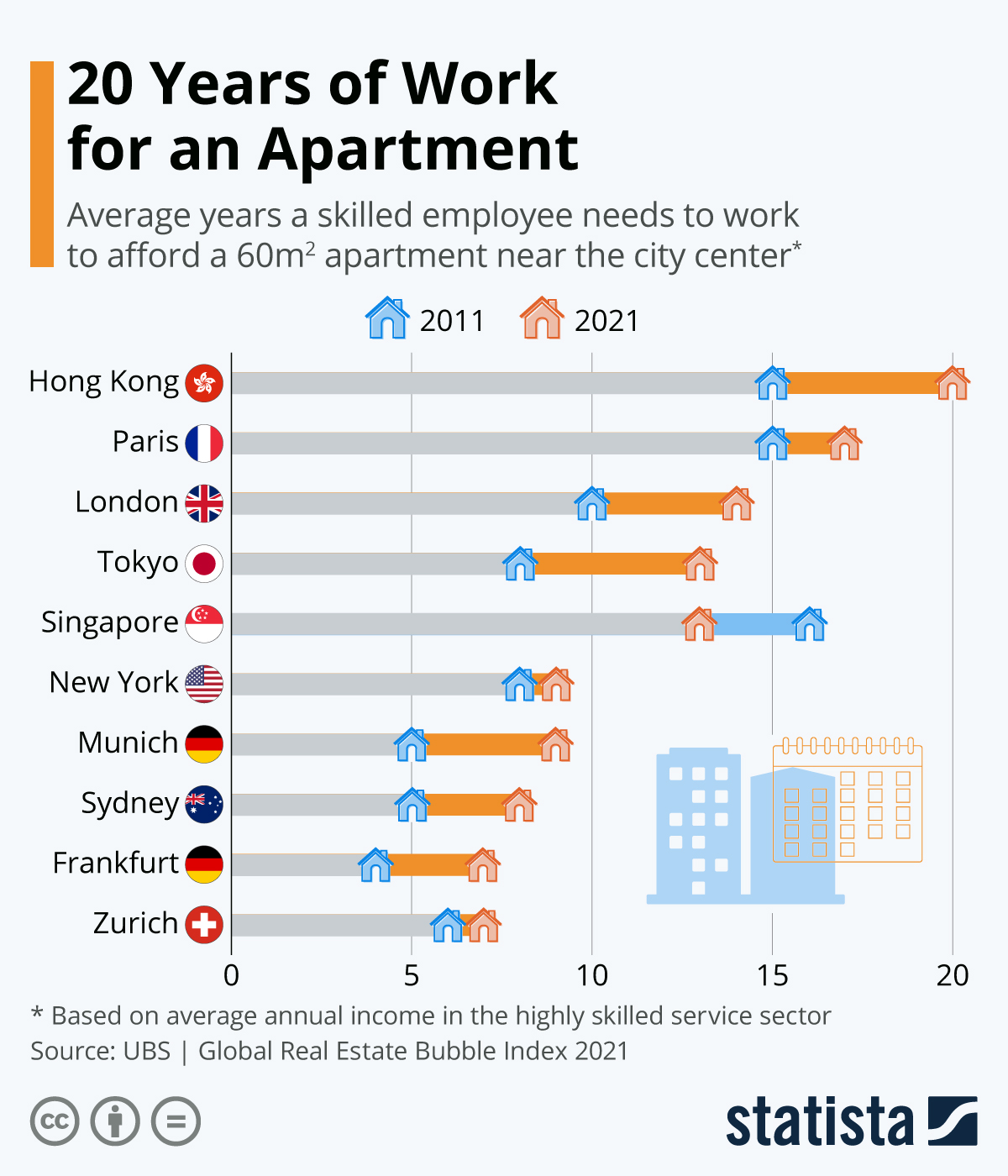

The key takeaway is that workers in Tokyo need to work for 14 years before they can buy property in the capital, up from 8 years when measured in 2011.

Source: Martin Armstrong, Statista

Other highlights mentioning Tokyo are below with a link to the original report at the bottom of the article.

Stronger house price dynamics (Page 4)

Real house price growth in the cities analyzed accelerated to 6% from mid- 2020 to mid-2021, the highest increase since 2014. Moscow, Stockholm, and the cities around the Pacific - Sydney, Tokyo, and Vancouver - recorded double-digit price growth.

Affordability continues to worsen (Page 4)

The average price-to-income multiple for a 60 square meter (650 sqft) apartment in the urban centers analyzed is currently above 8 [on price-to-income levels].

Next to Hong Kong, the cities with the worst affordability are Paris, London, and Tokyo where multiplies exceed 10.

Exuberance in lockstep (Page 5)

Frankfurt, Toronto, and Hong Kong top this year’s UBS Global Real Estate Bubble Index, with the three cities warranting the most pronounced bubble risk assessments in housing markets among those analyzed…...Housing market imbalances are also high in Tokyo, Sydney, Geneva, London, Moscow, Tel Aviv, and Singapore, while Madrid, Milan, and Warsaw remain fairly valued.

Hot but likely short-lived fireworks (Page 5)

House price growth in the cities analyzed accelerated to 6% in inflation adjusted terms from mid-2020 to mid-2021, the highest increase since 2014.

All but four cities - Milan, Paris, New York, and San Francisco - saw their house prices increase. And double-digit growth was even recorded in five cities: Moscow; Stockholm; and the cities around the Pacific, Sydney, Tokyo, and Vancouver.

Regional Cycles (Page 9)

Index scores have increased in all analyzed APAC cities over the 2.5 last four quarters. Hong Kong is the only market in the bubble risk zone...Real estate prices in Tokyo have been increasing almost continuously for over two decades, bolstered by attractive financing conditions and population growth.

The housing in the capital has decoupled increasingly from the rest of the country and become unaffordable. During the pandemic, demand for city housing has remained high, with imbalances increasing from undervalued 20 years ago to highly overvalued now.

Price-to-income (Page 10)

Buying a 60 square meter (650 square foot) apartment exceeds the budget of people who earn the average annual income in the highly skilled service sector in most world cities.

In Hong Kong, even those who earn twice the city’s average income would struggle to afford an apartment of that size. House prices have also decoupled from local incomes in Paris, London, Tokyo, and Singapore, where price-to-income multiples clearly exceed 10.

Select Cities - Tokyo (Page 21)

Against the background of a declining national population, the city is still adding to its numbers.

At the same time, a strong economy, relatively good job prospects, and falling mortgage rates have supported housing demand.

Consequently, real housing prices have been increasing almost uninterruptedly for the last two decades, resulting in a doubling of the price level.

In recent quarters, annual price dynamics have even accelerated into double-digit territory - one of the highest growth rates of cities covered in this study.

Sales of newly constructed buildings for the Olympics have also lifted prices. The housing price level in the capital has decoupled increasingly from the rest of the country’s, leading to stretched affordability that will likely curb future price growth.

Further Reading

Global Real Estate Bubble Index for 2021 (UBS; October, 2021)