Japan is facing several social and economic challenges over the next few years. Although Japanese President Shinzo Abe plans to continue the stimulus measures he set in place, since 2012 which should be a positive for the Japanese property market.

However cracks are beginning to show, according to Nikkei Asian Review rising resource costs, a worsening labour shortage and a flood of easy money are pushing property prices in Tokyo to near-historic levels.

The journal stated, “property prices skyrocketed during Japan’s asset bubble in the late 1980s”. The bubble’s collapse signaled the start of the country’s long period of stagnant wage growth and low consumption of goods.

Recently published by REthink Tokyo, “land prices in the Japanese capital have been on the rise again, but recently leveled off”. While real estate investment can either focus on ROI, (Tokyo is generally higher than in other world capitals), or on land price increase -- which has shown to be volatile in Japan over the past decades.

Supplied: Japan Property Central

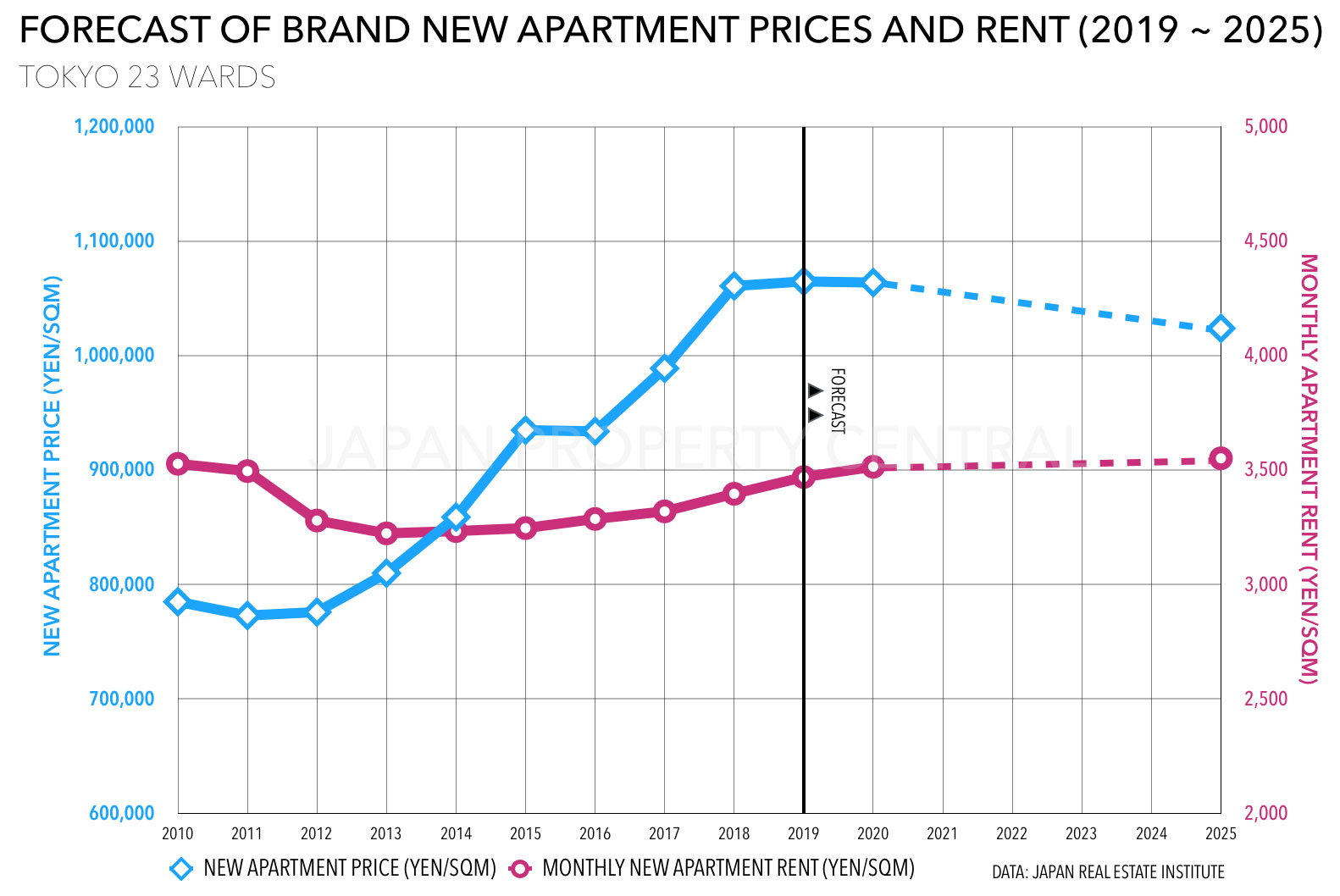

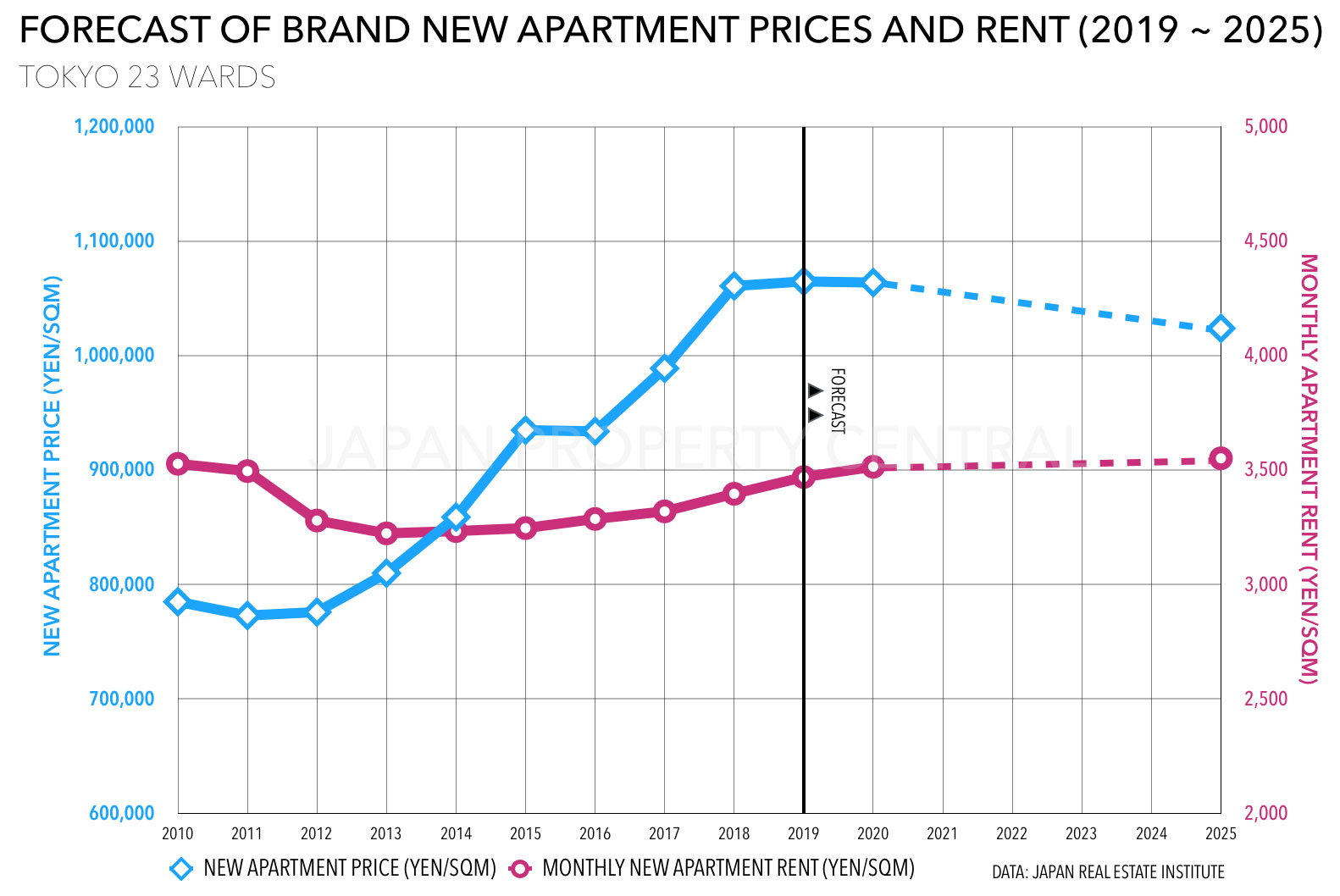

A clear indication of a downturn, according to forecast by the Japan Real Estate Institute (JREI), is the average price of brand-new apartments in Tokyo’s 23 wards. These properties are forecasted to have an annual growth rates of between 0.3 ~ 0.8% up until 2020, before starting to see a very slight year-on-year decline from 2021 onwards.

Prices are predicted to increase by 0.8% in 2018 to 952,000 Yen/sqm, 956,000 Yen/sqm in 2019 (+0.4%), and 959,000 Yen/sqm (+0.3%) in 2020. However, by 2025, the average price of a new apartment is forecast to be 928,000 Yen/sqm, which would be the same level seen in 2016, but 15% higher than the price in 2013 and 23% higher than the most recent bottom in 2009.

Back in 2014, the Institute forecasted that the average price of a new apartment would be 816,000 Yen/sqm in 2020, while the latest forecast puts it at 959,000 Yen/sqm (a 17.5% difference).

The average rent of an apartment is forecast to see slightly higher rates of growth in coming years with the average monthly rent in 2017 forecast to reach 3,334 Yen/sqm (+1.4%). Average rents are forecast to see annual growth of 0.8% in 2018, 0.7% in 2019 and 0.6% in 2020. From 2021 onwards, rents are forecast to stabilize and remain flat, reaching 3,395 Yen/sqm by 2025 (up 4.6% from 2015).

Sources: Nikkei Asian Review, Japan Real Estate Institute, Japan Property Central

Similar to this:

Olympic redevelopments in Tokyo: 5 key changes to know about

Tokyo apartment sales in May 2019

Shibuya’s decade-long facelift: Redevelopment timeline leading up to the 2020 Tokyo Olympics